Below are four common but ill-advised solutions for credit card debt. Fortunately however there are ways.

How To Get Out Of Credit Card Debt Real Simple

How To Get Out Of Credit Card Debt Real Simple

Although it might feel overwhelming you can tackle any debt the same way.

Best way to fix credit card debt. Using a Financial Advisor Retirement Planning 401k Plans IRAs Stocks Best Investment. When you pay off multiple cards youll reduce the number of accounts with balances on your credit reports. As mentioned the fewer accounts with balances on your credit the better.

If you could find an extra 40 in your. Moving your credit card debt to a single installment loan could help your credit in another way. If youre unable to make a.

First check any existing cards you have to see if they are offering 0 transfers. Pay Down Revolving Account Balances. Say you owe 2000 on a credit card with a 20 APR and a 40 monthly minimum payment.

Managing Your Debt Credit Cards. Take a cash advance on another card. Contact us at 800-810-0989.

Credit Cards 101 Best Credit Cards of 2020 Rewards Cards 101 Best Rewards Credit Cards Credit Card Reviews Banking. Paying off everything with a home equity loan. Use a balance transfer credit card.

The expression robbing Peter to pay Paul comes to mind with this one. As a result options to solve credit card debt. Best Banks Understanding Interest Rates Saving Accounts Checking Accounts CD Rates Credit Unions Investing.

This is called the avalanche method of debt repayment. Robbing your retirement savings. Credit card users owed a total of 834 billion in credit card debt.

First call your creditors to negotiate lower interest rates This is the all-important first step that most people skip. American credit card debt now totals 143 trillion -- a 11 percent increase from the previous quarter according to recent data the New York Federal Reserve. If you have debt across multiple credit cards its generally a good idea to start paying off the card with the highest interest rate first.

One step at a time. Now I want to give you a view of the American total credit card debt. You think youre fine then suddenly youre not.

Unfortunately most of us take too long to ask for the help we need. Of course the best way to get out of credit card debt is to take a lump sum from your savings account. One simple way to make a huge impact is to pay double the minimum.

Youre using credit cards for necessities and everyday purchases. One year ago the US. If you are on a low income and you are trying to get out of debt an excellent option is to get a balance transfer credit card.

The counselor may be able to negotiate lower payments and interest rates and get card issuers to bring your accounts current. Credit card debt has a way of creeping up and wreaking havoc with your budget. Start by learning what debt can do to your credit rating and why credit card debt can be particularly damaging.

For starters taking a cash advance on a credit card is a very expensive proposition. Total Consumer Credit Card Debt. You move the balance of one credit card to a second new credit card and this way you effectively pay off the outstanding balance.

According to the Federal Reserve the average American household has roughly 16425 in credit card debt. People often never call their creditors to. If not consider opening up a new card thats promoting a balance transfer offer.

For those having trouble with credit card debt talking to a credit counselor and getting on a debt management plan DMP could be a good option. However not everyone can make such a large payment. Heres a guide on how to pay off debt and how to pay off credit card debt in particular even when it seems impossible.

Cash advances repeated balance transfers payday loans or any other form of debt to pay your credit cards simply create more debt by borrowing money to stay afloat. The best way to reduce credit card debt Step 1. If you are lucky you might have enough to pay it off in one fell swoop.

5 Strategies To Dig Yourself Out Of Credit Card Debt Credit Card Debt Settlement Credit Debt Credit Cards Debt

5 Strategies To Dig Yourself Out Of Credit Card Debt Credit Card Debt Settlement Credit Debt Credit Cards Debt

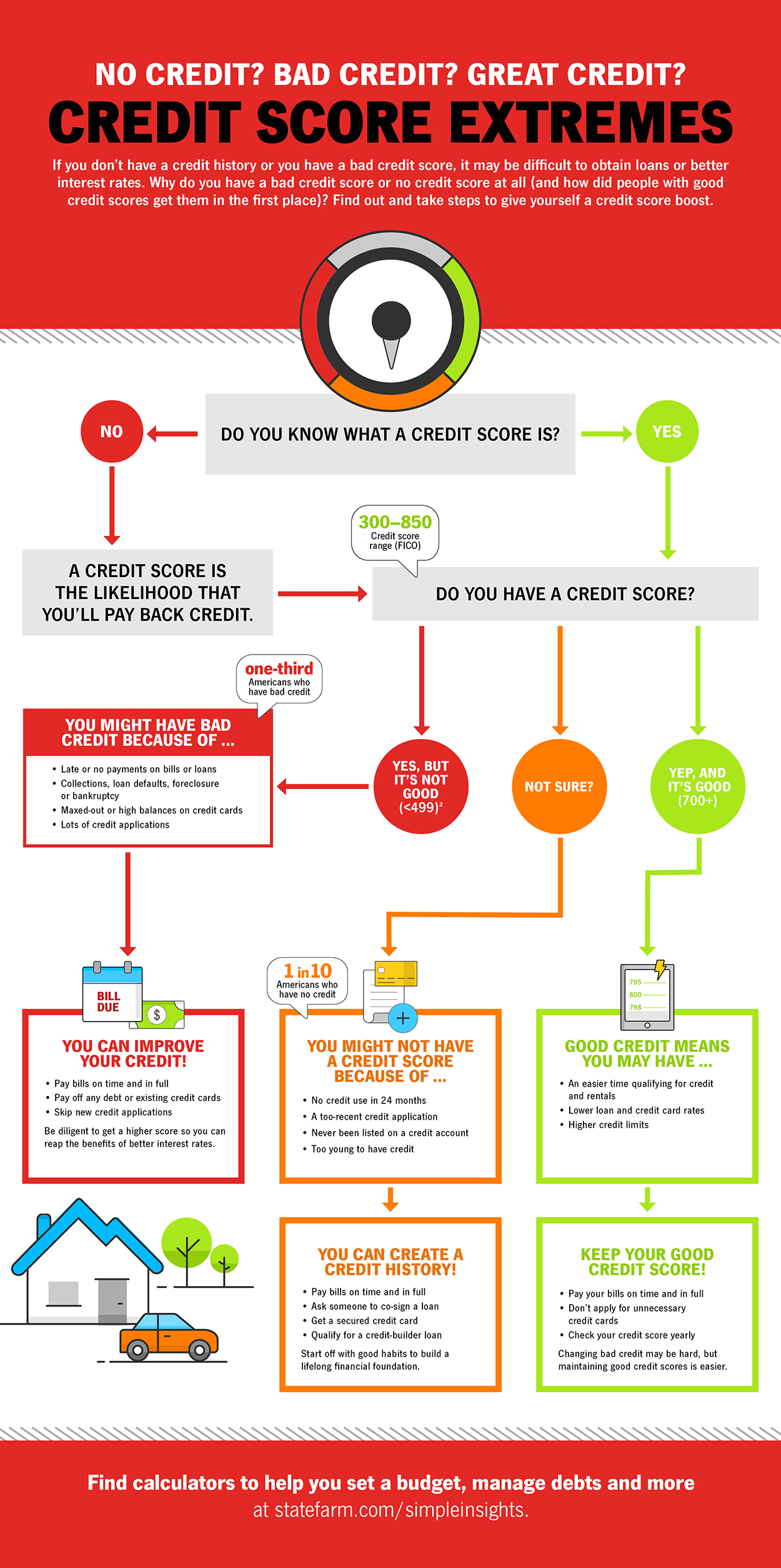

How To Build Your Credit Score State Farm

How To Build Your Credit Score State Farm

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Got To Maintain Good Credit Here S A List Credit Card Solution Tips And Advice Credit Repair Services Rebuilding Credit Credit Repair Companies

Got To Maintain Good Credit Here S A List Credit Card Solution Tips And Advice Credit Repair Services Rebuilding Credit Credit Repair Companies

How Does Debt Consolidation Affect My Credit

How Does Debt Consolidation Affect My Credit

:max_bytes(150000):strip_icc()/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg) Ways To Avoid Credit Card Debt

Ways To Avoid Credit Card Debt

How To Fix Your Credit Score Advance America

How To Fix Your Credit Score Advance America

/how-will-debt-settlement-affect-my-credit-score-960540_V3-4a211a80452d4879a8240457b9f0e584.png) How Will Debt Settlement Affect My Credit Score

How Will Debt Settlement Affect My Credit Score

How Do Debt Relief Programs Work What Credit Card Relief Program Is Best

How Do Debt Relief Programs Work What Credit Card Relief Program Is Best

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

How To Get Out Of Credit Card Debt Real Simple

Got Credit Card Debt Avoid This One Huge Mistake How To Fix Credit Secure Credit Card Guaranteed Approval Credit Card

Got Credit Card Debt Avoid This One Huge Mistake How To Fix Credit Secure Credit Card Guaranteed Approval Credit Card

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.