Once that five-year period ends youll continue receiving periodic. Whether you have a debt to pay off an investment to pursue or any other situation you can sell annuity payments instead of going through the hassle of applying for a bank loan.

Selling My Annuity Payments Options Legal Process More

Selling My Annuity Payments Options Legal Process More

When considering whether to sell your annuity its also important to consider all the factors involved with the sale including the value of your annuity discount rates and tax implications.

Sell your annuities. In exchange for receiving a lump sum up front you will agree to sell your annuity at a discounted amount based on. Just as it sounds this option is for those looking for the maximum sum of money. Then after the period of annuity payments that you have sold passes you will resume receiving the remaining periodic payments.

Top Reasons To Sell An Annuity. You can choose to sell your annuity payments for a set period of time. If you decide you want to sell your annuity payment for an immediate lump sum of cash there are a few different ways you can do it.

You can find more information about annuities in this page. Selling an annuity is a business deal. Call today to get a free no obligation estimate on how much money you can get for selling your annuities for cash.

Receive Your No-Obligation Quote Once we are able to gather information on your annuity and determine what the. Factoring companies intend to profit from their purchases. Sometimes annuity owners feel more secure selling only a portion of their annuity.

Account for the Discount Rate. Selling your annuities may not be appropriate anymore when you have not established an emergency fund to cover living expenses for at least three to six months. Discount Rates When you sell your annuity you will not be paid the full amount the annuity is worth.

There are three ways you can sell your annuity. You simply sign a contract record a change of ownership with the insurance company that issued the annuity and once the ownership change is complete you receive your lump sum payment. Selling your annuity payments exchanges the future value of an inflexible fixed asset with a present cash lump sum paid in full to the annuitant at the time of approval.

For example say your annuity that covers you for life and youre 40 years old. Yes you can sell your annuity payments for cash. Decide if you need money right now and what you will use it for.

Selling annuities is a feasible choice for individuals who need cash ASAP. In the event your financial needs change and an annuity is no longer meeting your needs you can sell your current or future payments for a lump sum of cash. Annuities can be sold in portions or in an entirety.

You can sell payments for five years. You may then be able to sell an annuity. With this option you are choosing to sell your annuity or structured settlement in its entirety ending any chance of periodic income payments in the future.

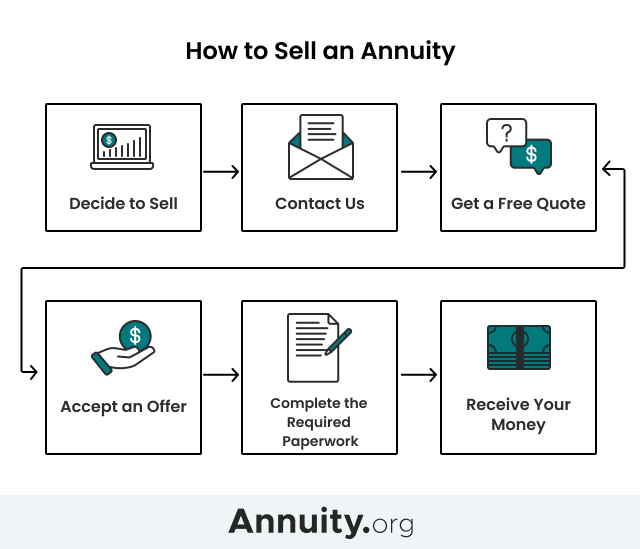

The process for selling your annuity follows the same basic steps. If playback doesnt begin shortly try restarting your device. After this time is over you can resume receiving your annuity payments as.

Selling Annuity Payments in 4 Easy Steps. But the most often cause to accelerate your annuity into cash is. For immediate assistance or for more information on selling annuity payments for cash call Rising Capital today at.

Weve narrowed down some of the more common reasons people decide to sell an annuity below. Under current rules once youve bought an annuity you cant change the decision. How To Make Selling Annuities A Super Simple Process.

This sells your payments from the annuity for a set period of time. Pay down student loans. There is also the option of selling your entire annuity contract which will result in a larger payment.

A partial sale allows you to receive a lump sum of money for a portion of your annuity payments. Selling Your Annuity Payments Step One. Either one will help.

This means youll be offered less than the total worth of your annuity. Heres how they compare. Speak with a Representative The first step toward getting your lump sum is reaching out to one of our.

Get quotes from multiple factoring companies or settlement funding companies. If thats the case your answer is an absolute yes. Annuity rules will change in 2017.

Can I Sell My Annuity. We take care of the complicated details and legal paperwork for you. Videos you watch may be added to the TVs watch history and influence TV.

Similarly if you have not contributed to other more tax-advantaged retirement accounts such as a 401k 403b Roth IRA etc or plan on receiving the money before age 59 ½. Before selling your annuity seek help from a trusted financial advisor or attorney. They should offer.

Pay down credit card debt in order to improve credit-score Pay down outstanding medical bills. Financing a Divorce or Marriage. A partial sale a sale in its entirety or lump sum sales.

We are happy to provide you with a full buyout option and will guarantee the highest value. Unlike selling your structured settlement annuity if you want to sell your annuity it does not require a court order.