Check out quickly and securely with a contactless card without touching a. Finden Sie perfekte Stock-Fotos zum Thema Young Adult Credit Card sowie redaktionelle Newsbilder von Getty Images.

Best Credit Cards For Young Adults First Timers May 2021

Best Credit Cards For Young Adults First Timers May 2021

30646 young girl credit card stock photos are available royalty-free.

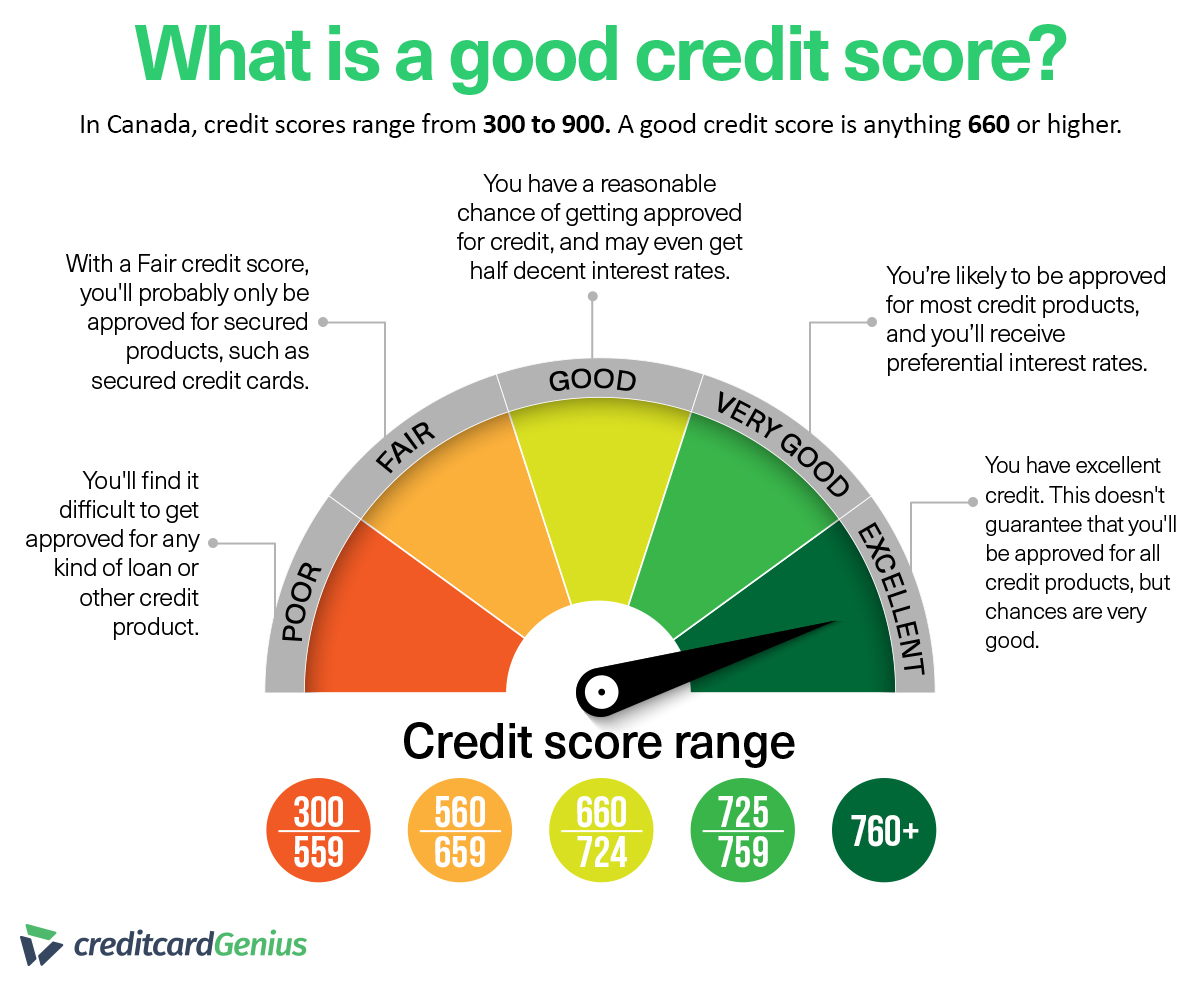

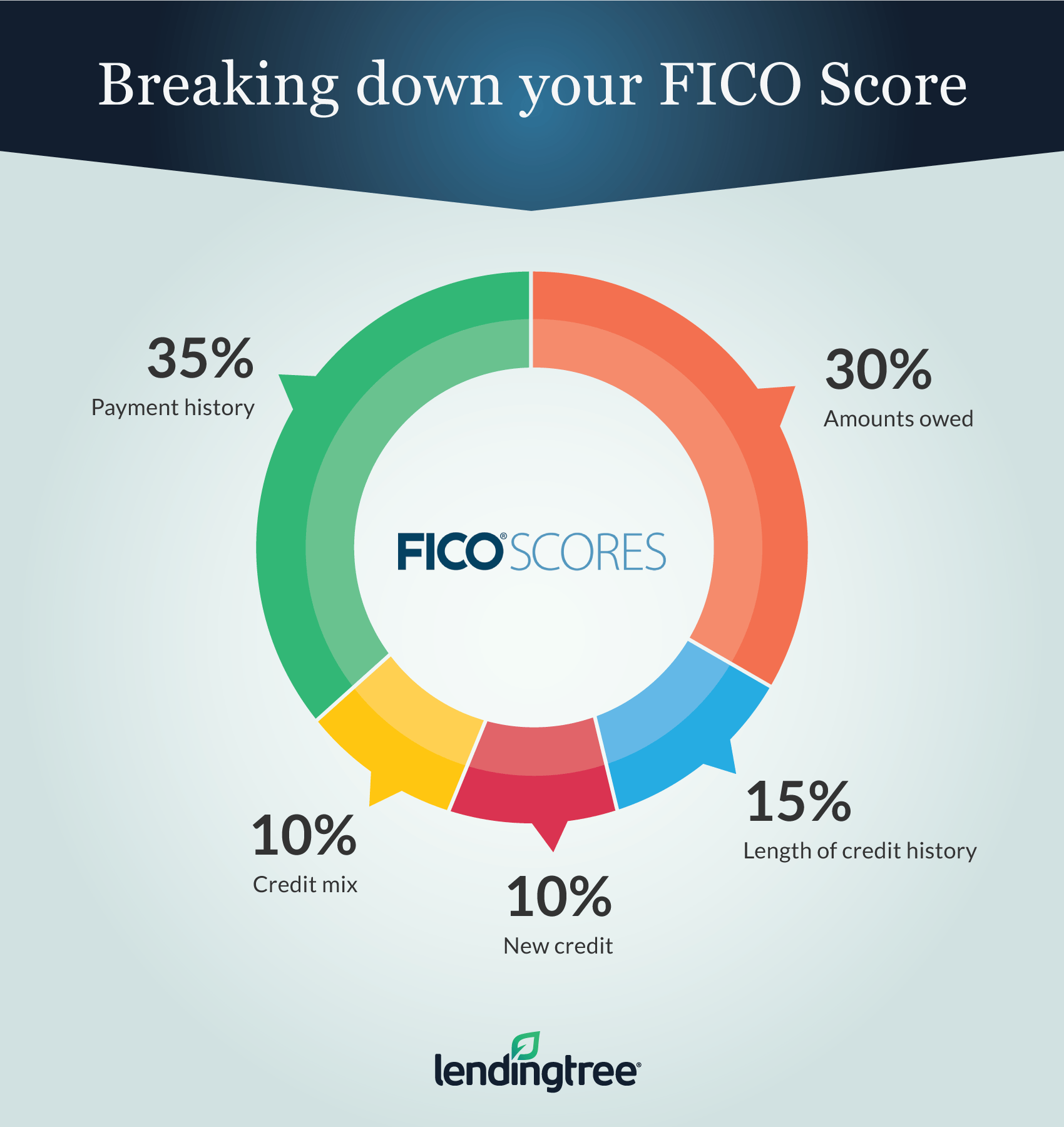

Young credit card. When youre younger its unlikely that youll have much of a credit history which is what lenders normally use to evaluate credit card applications. Keep in mind that your credit limit isnt your budget. Capital One Platinum Credit Card.

No one under the age of 18 can be considered for credit on their own. Wählen Sie aus erstklassigen Inhalten zum Thema Young Woman Holding Credit Card in höchster Qualität. Innerhalb des monatlichen Limits Verfügungsrahmens der Kreditkarte können Sie Einkäufe in Geschäften im Internet und in Tele-Shops bezahlen.

Choose a credit card you can manage. Finden Sie perfekte Stock-Fotos zum Thema Young Credit Card sowie redaktionelle Newsbilder von Getty Images. See application terms and details.

Should I be getting a credit card. Secured Mastercard from Capital One. Download all free or royalty-free photos and vectors.

In this case a. Capital One QuicksilverOne Cash Rewards Credit Card. Wählen Sie aus erstklassigen Inhalten zum Thema Young Adult Credit Card in höchster Qualität.

Its best to treat your credit card as a debit card and only use it for purchases that you can afford to pay off. CSX Young ist das umfassende digitale Banking-Angebot der Credit Suisse für alle zwischen 12 und 25 Jahren. If you do want to get a card with an annual fee youll find more premium options.

How Should Young Adults Use Credit Cards. Best credit cards for young adults new to creditno credit Jasper Cash Back Mastercard. Entsprechend wird die Karte vermutlich erst ab der Ausbildung interessant.

Your Young Credit Card stock images are ready. Wählen Sie aus erstklassigen Inhalten zum Thema Young Credit Card. Es bietet alle wichtigen Bankdienstleistungen die Sie in Ihrem Alltag benötigen einschliesslich der CSX Premium Black Debit Mastercard.

Best Unsecured Credit Cards For Young Adults 1. Ebenso können Sie mit Ihrer Kreditkarte Bargeldauszahlungen am Geldautomaten vornehmen. Not paying off credit card balances.

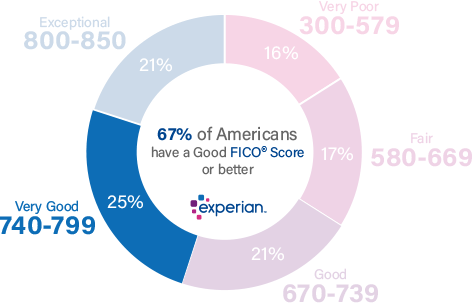

Credit card applicants under 21 In the United States the US Credit CARD Act of 2009 requires a person under the age of 21 to prove their financial independence and ability to repay a debt before they can be approved for a credit card without a cosigner. In addition to 0 fees the Petal 2 Visa Credit Card gives 1 - 15 cash back in rewards on purchases. The best credit card for young adults is the Petal 2 Visa Credit Card because it combines low costs with high approval odds and generous rewards.

Pretend that your credit card is a debit card. Einfach sicher digital und kostenlos. You dont need to maintain a credit.

Use them in commercial designs under lifetime perpetual. Access to a credit card leads some young people to spend more than they can afford to pay off each month. This means your credit card options will be slightly limited compared to someone with a long credit history.

Young professionals have a large variety of excellent credit cards to choose from. Die Young Visa Kreditkarte können Sie weltweit bei allen Akzeptanzstellen einsetzen die das Visa-Logo zeigen. Credit card offers can be attractive with some touting over-the-top bonus.

Carrying a balance leads to interest charges and having a high balance can hurt your credit scores. Finden Sie perfekte Stock-Fotos zum Thema Young Woman Holding Credit Card sowie redaktionelle Newsbilder von Getty Images. If the most rewarding credit cards are still out of reach there are still very good credit cards designed for consumers with average or limited credit.

Furthermore the CARD Act of 2009 prevents young people under the age of 21 from obtaining a personal credit card without proof of income or an adult co-signer with good credit. Die Commerzbank Young Visa ist nur in Kombination mit dem kostenlosen Start-Konto erhältlich und nur bei einem monatlichen Mindestgeldeingang in Höhe von 300 Euro kostenlos. Best for young adults with low credit scores Many young people may find it hard to qualify for the majority of credit cards when theyre just starting their credit journey or if their credit scores are on the low side.

What are the best credit cards for young professionals. Most of these cards have no annual fee and offer valuable rewards on select categories of purchases.