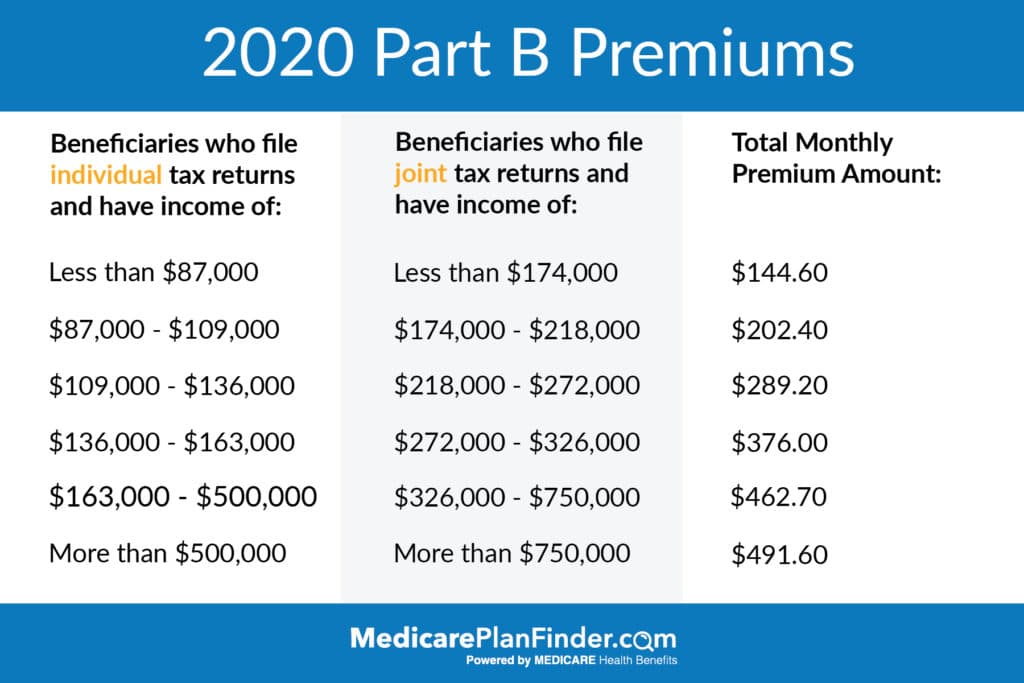

Each year the Medicare premiums deductibles and coinsurance rates are adjusted according to the Social Security Act. You might pay more if you have a high income.

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

This accounts for around 25 percent of the monthly cost for Part B with the government ie.

What is medicare part b premium. Part B is medical insurance and covers certain outpatient care such as doctors office visits preventive care medical equipment and other qualified services. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount youll pay the standard premium amount and an Income Related Monthly Adjustment Amount IRMAA. If your income exceeds a certain amount.

The program is for Medicare Part C plans also called Medicare Advantage plans which are offered by private insurance companies but still approved and regulated by the Centers for Medicare Medicaid Services CMS. Medicare Part B Premiums Understanding Medicare Part B Premiums. Medicare Part B covers inpatient services like doctor visits and lab work.

When you are first eligible for Medicare you have a seven-month Initial Enrollment. Most people pay the standard Part B premium amount. Medicare Part B generally pays 80 of approved costs of covered services and you pay the other 20.

Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. In 2020 the monthly premium starts at 14460 referred to as the standard premium. If your MAGI from two years prior is under 88000 or under 176000 for a couple then youll only have to pay the standard Part B premium of 14850.

The premium is subject to a yearly change by Medicare itself. The standard monthly Part B premium in 2021 is 14850. The standard Part B premium amount in 2021 is 14850.

While zero-premium liability is typical for Part A the standard for Medicare Part B is a premium that changes annually determined by modified adjusted gross income and tax filing status. In 2020 this equates to 252 per month for 30 to 39 quarters and 458 per month for less than 30 quarters. Medicare Part B premium.

Medicare Part B covers physician services outpatient hospital services certain home health services durable medical equipment and certain other medical and health services not covered by Medicare Part A. 7 Zeilen What are Medicare Part B Premiums. In 2020 the standard Medicare Part B premium is 14460.

Medicare Part B PremiumsDeductibles. Medicare Part B covers physician services outpatient hospital services certain home health services durable medical equipment and certain other medical and health services not covered by Medicare Part A. The standard Medicare Part B premium for medical insurance in 2021 is 14850.

Eligibility for Medicare Part B. Youll pay a particular price each year regardless of your location the plan you choose and your health condition. Part B premium based on annual income.

The standard premium is 14460 in 2020. Each year the Medicare premiums deductibles and copayment rates are adjusted according to the Social Security Act. The standard Part B premium amount is 14850 or higher depending on your income.

So the Medicare Part B standard premium for 2020 is 144198. The standard rate increased to 144 from 135 in 2019. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

Medicare premiums are calculated based on MAGI which is your modified adjusted gross income. For 2020 the standard monthly rate is 14460. The standard monthly Part B premium.

If you were paying the standard monthly premium for your Part B youll pay about 10 more. However and the price will last for this year. Part B is optional and pays a portion of nonhospital-provided medical care such.

Medicare Part B PremiumsDeductibles. The standard premium also may apply to you if get both Medicare and Medicaid benefits but your state may pay the standard Medicare Part B premium if you qualify. Medicare Part B premiums change from one year to the.

In 2021 the standard Part B premium is 14850 per month but not everyone pays the same Part B costs. The Medicare program paying the remaining 75 percent. The Part B premium on the other hand is based on income.

Part B deductible and coinsurance. Most Medicare beneficiaries will pay a higher standard monthly premium for their Part B. Some services like flu shots may cost you nothing.

As we mentioned the Medicare Part B Premium Giveback is a program in place to help you receive some money back on your Part B premium. 14460 is what you have to pay as a monthly premium for Medicare Part B. Most people pay a monthly premium for Medicare Part B.