Its unclear what kind of credit scores youll need to qualify for the Apple Card but assuming you are creditworthy you might benefit from this card if. Some have been approved with credit scores in the 600 range.

Goldman Explains Apple Card Algorithmic Rejections Including Bankruptcies Venturebeat

Goldman Explains Apple Card Algorithmic Rejections Including Bankruptcies Venturebeat

Apple lists a FICO credit score of less than 600 as an example of a score that may be too low to qualify for the Apple Card.

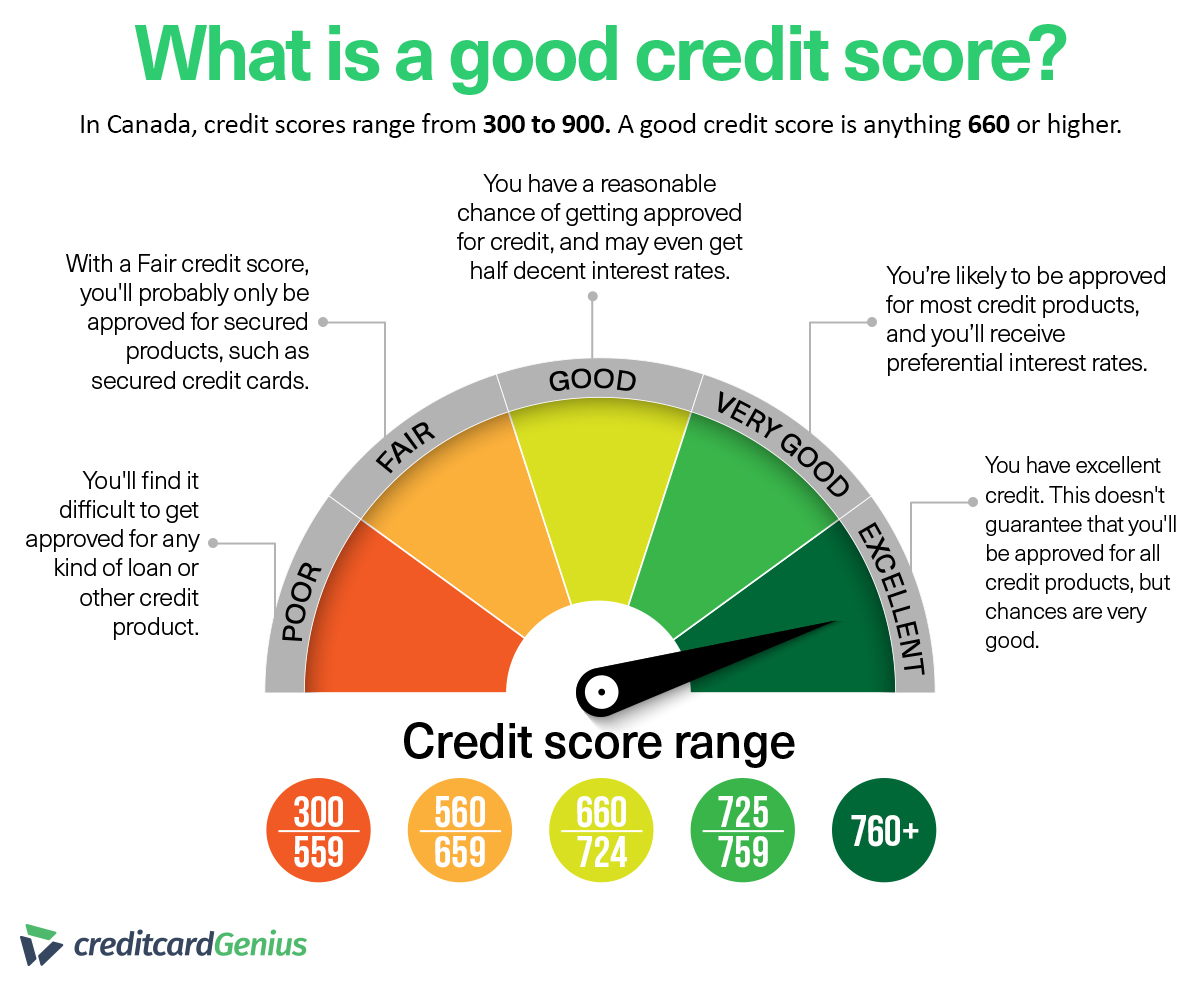

What is the credit score for apple card. FICO Score 9 ranges from 300 to 850 with scores above 660 considered favorable for credit approval. A FICO credit score of at least 600 which falls in the fair range is needed to be approved for the Apple Card. It makes sense in a way since Apple products are so pricey.

First off you need excellent credit scores to get an Apple credit card. The Apple Card requires a minimum 600 FICO credit score making it possible to get approved with fair credit. Apple Card gives you unlimited 3 Daily Cash back on everything you buy from Apple whether its a new Mac an iPhone case games from the App Store or even a service like Apple Music or Apple TV.

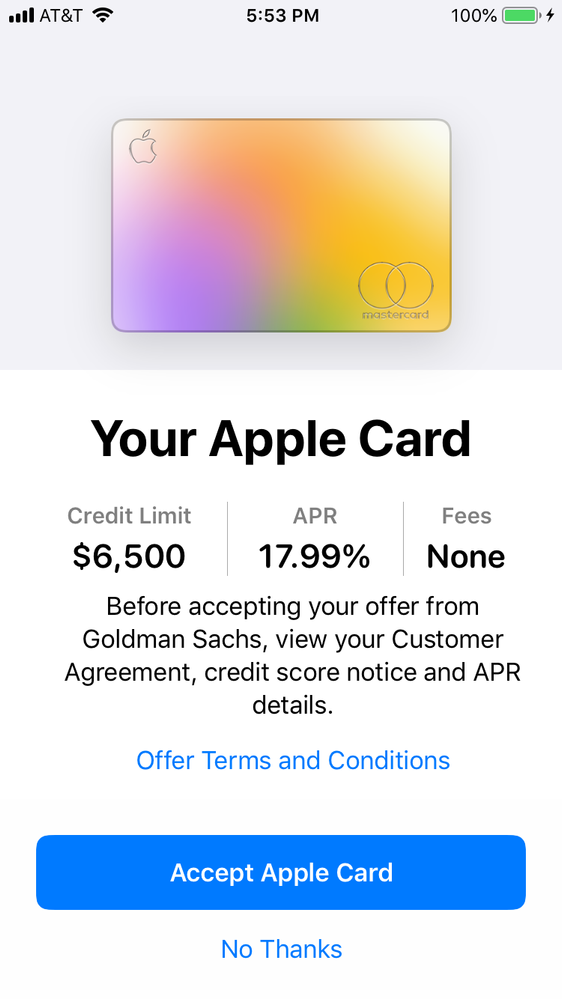

Heres what you need to know about the Apple Card and its reporting changes to the major credit bureaus. FICO scores may be the industrys standard for credit decisions but they dont always tell the whole story of your financial fitness. With my 800 credit score I got 1000 usd credit limit not even enough for a new iPhone.

The Apple Card has been a resounding success for the tech giant since its launch last year. Apple juice runs through your veins. Why your credit score is used Credit scores can indicate how you use and pay off debt.

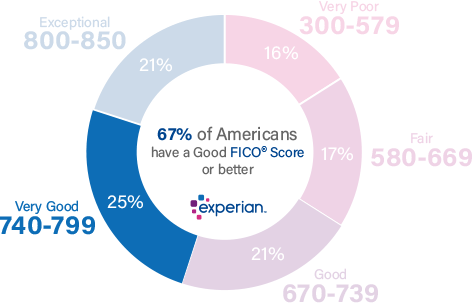

Apple Card is still rolling out in waves to users who expressed interest on Apples website. First the most commonly used credit score range is 300 850. Now however the card appears to be reporting to all three major credit bureaus regularly.

Apple Card Reporting to Experian Equifax and TransUnion. So what credit score is needed for an Apple Card. However there have been reports of approvals with a score as low as 600.

Apple Card uses FICO Score 9. However there are some negative credit items that could hurt your chances of getting approved including past-due accounts or a recent bankruptcy or repossession. The bank behind the Apple Card Goldman Sachs has reportedly been approving applicants with subprime credit scores a term with a varying definition but often defined as.

You need to show that you can handle your payments on time and have good credit history. That means subprime borrowers or. The basic range of credit score categories are as follows.

And my card utilization will be so high that it hurts my credit score. What Credit Score Do You Need for an Apple Card. A wider window for approval.

A score of over 600 is no guarantee of approval however and plenty of users have reported being denied for the card with scores in the 700s. The Apple Card offers an APR between 1099 percent and 2399 percent based on your credit score. If you want to buy in the big leagues you need to show that you can deal with the responsibility.

I just applied the Apple Card through my phone. If your credit score is low for example if your FICO9 score is lower than 600 4 Goldman Sachs might not be able to approve your Apple Card application. On the low end thats lower than the national average APR of 1767 percent but it.

Its good to note that the Apple Card credit score requirement is comparable to that of similar cards on the market. For example he estimates that someone with a credit score of less than 650 may be unlikely to get a better offer rewards-wise than Apples financial product. October 25 2020 Credit Are you thinking about applying for the Apple Financing.

The minimum recommended credit score for this credit card is 640. The Apple Cards credit score requirement is good. Theyre not literally taking.

While its possible to be approved with a lower score due to a high income or other positive factors its best to not take the risk. Apple Card offers an APR between 1324 and 2424 based on your credit score and all approved cardholders will be placed at the bottom of the interest tier they fall into which will save everyone a little bit of interest. Barclaycard a third party financial institution sponsors the Apple credit card.