In 2021 the maximum benefit increases by 137 per month to 3148. In 2021 the limit is 18950 for those reaching their full retirement age in.

Social Security Trust Fund Wikipedia

Social Security Trust Fund Wikipedia

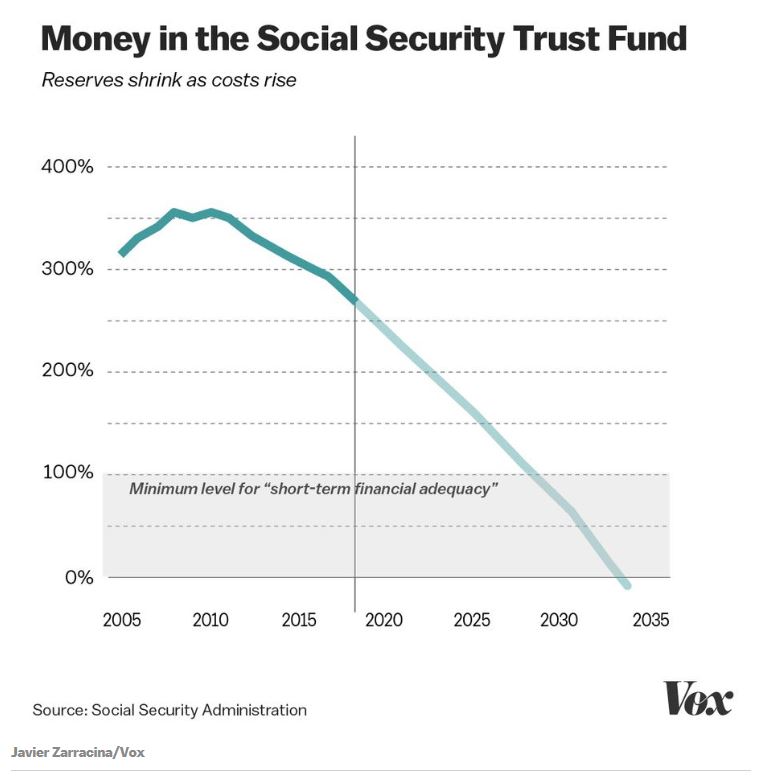

On the surface Social Securitys financial situation looks solid.

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

How much money is in social security. Remember income tax withholding. Heres how to estimate how much you will get from Social Security in retirement. If you are a Social Security retiree you may be wondering if youre likely to receive this soon-to-be authorized COVID-19-related payment and how much money youre in line to get.

Factor in your retirement age. The limit for joint filers is 32000. The statements no longer arrive automatically each year but Social Security mails them.

In 2020 the maximum monthly Social Security benefit for a worker retiring at full retirement age was 3011. Social Security may provide 33773 If you start collecting your benefits at age 65 you could receive approximately 33773 per year or 2814 per month. Heres what you.

A 1500 per month your Social Security benefit is worth hundreds of thousands of dollars at a minimum and that doesnt factor in ancillary benefits like spousal benefits or survivor benefits. 76 percent from interest on the money in the trust funds. Think about the cost of employing thousands of.

The limit is 25000 if you are a single filer head of household or qualifying widow or widower with a dependent child. If you are married filing separately you will likely have to pay taxes on your Social Security. Social Security makes information on your accumulated payments available on a Benefit Statement.

The resource limit for a couple is only slightly more at 3000. 15 That is about to change however. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer.

At one time the agency mailed out these statements every year to all workers with a record of covered earnings meaning those who had contributed payroll or self-employment taxes to the Social Security trust fund. For security the Quick Calculator does not access your earnings record. For reference the estimated average Social Security retirement benefit in 2021 is 1543 a month.

If youre looking to collect Social Security benefit checks that are as large as possible think twice before earning a lot of money. The maximum benefit the most an individual retiree can get is 3148 a month for someone who files for Social Security in 2021 at full retirement age or FRA the age at which you qualify for 100 percent of the benefit calculated from your earnings history. Calculate your Social Security payment.

Youd need 529411 for it to last 30 years. The trust funds had 29 trillion in reserves at the end of 2019 but benefit payments going out are increasingly outstripping income thanks to. Instead it will estimate your earnings based on information you provide.

In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240. So benefit estimates made by the Quick Calculator are rough. This is 447 of your final years income.

Social Security Quick Calculator. SSI eligibility guidelines stand in stark contrast to those of the SSDI program as far as having money in the bank or owning other assets. The Value Is Even Higher for Married Couples.

SSA limits the value of resources you own to no more than 2000. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. Consider the average payment.

34 percent from income taxes Social Security recipients pay on their benefits. 4 Social Security. Dont earn too much while collecting benefits.

Benefit estimates depend on your date of birth and on your earnings history. Of the remainder 65 billion went to cover the Social Security Administrations SSA administrative expenses. Over time the Social Security Trust Fund accumulated a reserve that at the end of 2019 totaled nearly 29 trillion.

In 2018 Social Security took in a total of 1003 trillion. If youve earned 69000 from one job and 69000 from the other youve crossed over the wage base threshold.

/money_market__currency_chart_-5bfc2efa46e0fb00517c8ac0.jpg)

/1964-2014_t20_YzObm11-5ae1f18ea474be00366fbfd2.jpg)