Here are 7 ways to build credit without a credit card plus one way that is technically a credit card but doesnt require you to have credit to get it. You can get one of these loans from a community bank or credit union.

How To Build Improve Credit Patriot Federal Credit Union

How To Build Improve Credit Patriot Federal Credit Union

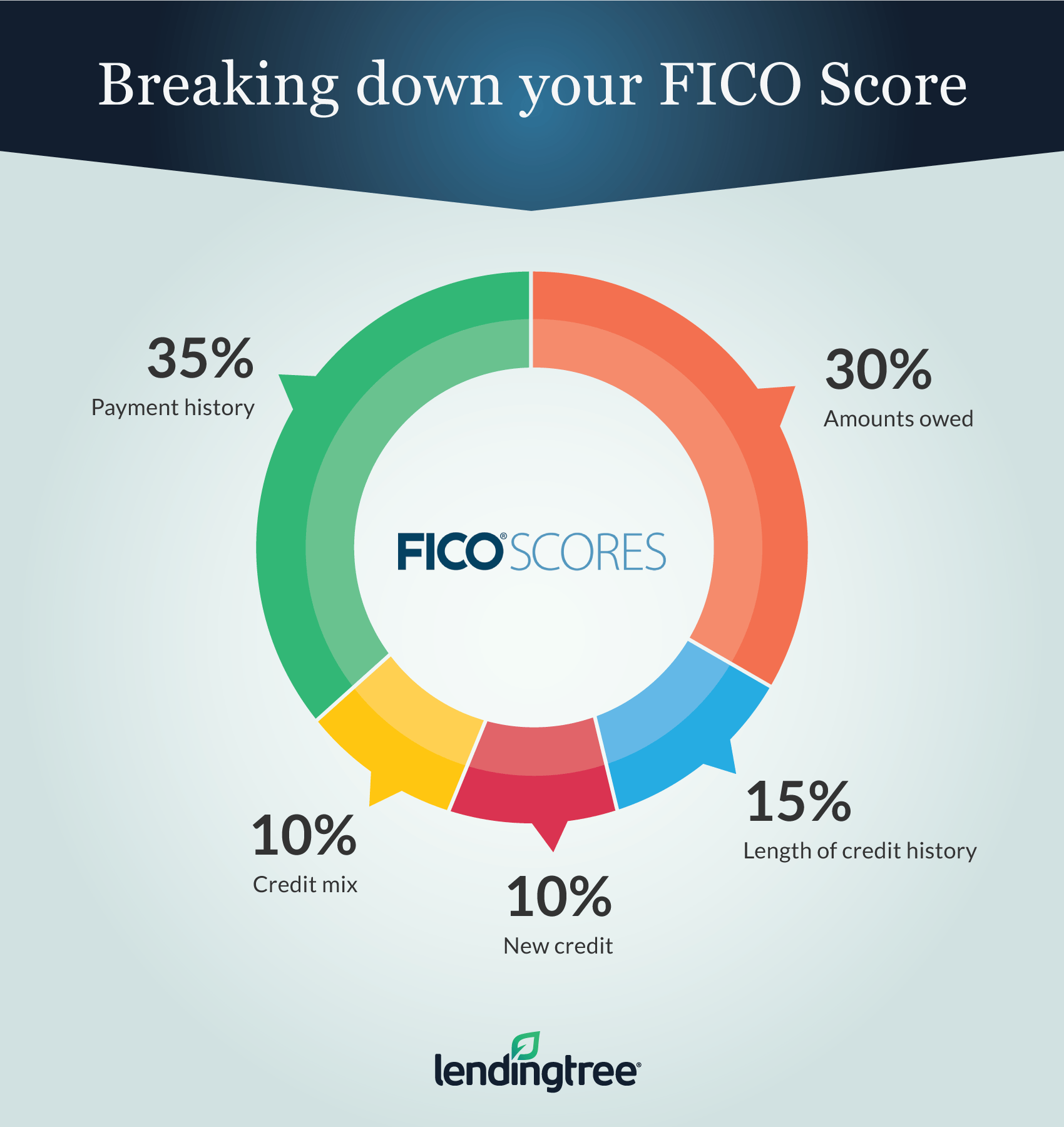

The most important factor in your credit scores is payment history.

How to build credit with low score. Pay your bills on time 2. Get a secured credit card. Also the credit bureaus like to see consistent on-time payments to boost your credit score.

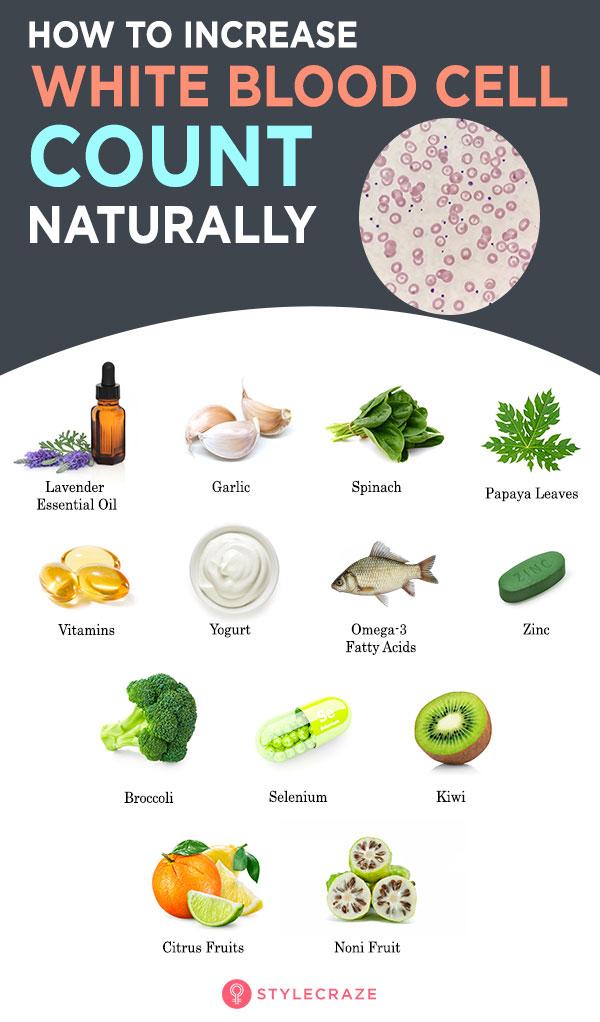

The best way to build credit is to focus on the 5 major factors that impact your credit score like paying your bills on time keeping your credit utilization low not opening too many new credit accounts in too short a time and using all types of credit responsibly. Once you have a strong credit score you can close the secured card account and apply for an unsecured credit card. Lastly keep the faith.

Carry a 0 balance on a card with a 1000 limit and your ratio is 0. To raise your credit score the credit bureaus need to see you are using your credit wisely and making payments on time. As an authorized user you can piggyback off.

The longer you keep using credit responsibly and paying on time the more your score will improve. A low credit score doesnt have to follow you forever. Heres how to boost it Heres how to boost it Published Fri Apr 30 2021 800 AM EDT Updated Fri Apr 30 2021 1126 AM EDT.

This would help you to build credit score. Rebuilding your score to a respectable level can take months or years depending on how bad your credit score is to begin with and. The lender will put the money you borrow into an account and youll make payments on the money until the full amount is paid.

You can rebuild your credit by raising your credit score little by little. To get a low mortgage rate your credit score matters. Monitor your credit report and score regularly Building a great credit score takes time.

Even if you have poor credit passbook or CD loans are relatively easy to secure. Updated February 25 2021. Your debt-to-credit ratio is basically how much debt you have compared to how much credit you have available.

Secured cards are your best bet if your credit score is really low. To build credit with your credit card make at least your minimum payment on time every month. Getting rid of the negative credit report information and catching up on past due bills is the best way to start rebuilding bad credit.

For example if you have a Fair credit score 580-669 you can save timeand hard inquiries to your credit reportby waiting to apply for better credit cards until after youve built up your credit. Start building an emergency fund. Pay bills on time and in full.

Use this information to narrow down which cards may be best for you. For instance you could lock your credit card in a drawer and your score would still improve. Making payments on time and keeping your balances low are the two most important factors when it comes to building credit Griffin says.

Once you get a credit card you can build credit by using it every month paying off your purchases on time and keeping a low credit utilization less than 30. Life is unpredictable and if you have a financial cushion it gives a little protection to your cash flow as well as to your credit score. Considering the same example with the credit limit of 1500 you may want to keep your balance below 450 to nail down that 30 credit utilization rate.

Credit-builder loans for instance can help you start building credit. If you miss your bills due date the card issuer may charge you a fee and you could lose any. But there are many ways to build credit with a credit card other than making purchases and payments.

Before applying for a loan with the intention of building credit always confirm that the lender will report your account and payment history to one or more of the three main credit bureaus Experian TransUnion and Equifax. One of the simplest ways to build credit is by becoming an authorized user on a family member or friends credit card. In fact payment.

Secured credit cards require a security deposit to get approved for the account but when used responsibly they can be a great tool for improving a credit score. Get the best financing deals and secure your dream job or home with a high credit score. Apply for a credit-builder loan This is a loan used specifically to build a credit score.