Your 21 day average starts from this point - so you can usually expect your tax refund the last week of February or first week of March. Many refunds are taking longer during the pandemic.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance but it can take longer.

Estimated tax return date. Also if you claimed the Earned Income Credit EITC or the Additional Child Tax Credit ACTC that may be why you are seeing a delay as the IRS could not begin processing those until after February 15. Depending on IRS security procedures the tax refund date could take up to 21 days after the IRS tax return acceptance date or as early as 7 days via the bank direct deposit method. In general the IRS says e-filed returns are usually processed and refunds issued within 21 daysor less than two weeks for simpler tax returns.

18 2022 You dont have to make the payment due January 18 2022 if you file your 2021 tax return by January 31 2022. Most refunds will be issued in less than 21 days. June 15 2021 3rd payment.

As of April 30 2021 this 2020 Tax Calculator will takes into account the Unemployment Compensation Exclusion amount as establisted in the American Rescue Plan. 15 2021 4th payment. How long does it take to process a return sent by mail.

Well it depends on when and how you file your taxes. If you have the Earned Income Tax Credit or Additional Child Tax Credit your refund does not start processing until February 15. Use this Calculator to estimate your taxes owed or tax refund results.

You can start checking the status of your refund within 24 hours after you have e-filed your return. The refund schedule below assumes that tax season for filing 2019 tax returns will start on Jan. Learn who must pay make estimated taxes how to determine your tax payments and when to make them.

When a due date falls on a weekend or legal. 38 rows Approximately 90 of taxpayers will receive their refunds in less than 21 days from the day their. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023.

Remember the fastest way to get your refund is to e-file and choose direct deposit. INCOME TAX CALCULATOR Estimate your 2020 tax refund. Per the IRS most refunds are received within 21 days from the time a return has been accepted and a refund option is selected.

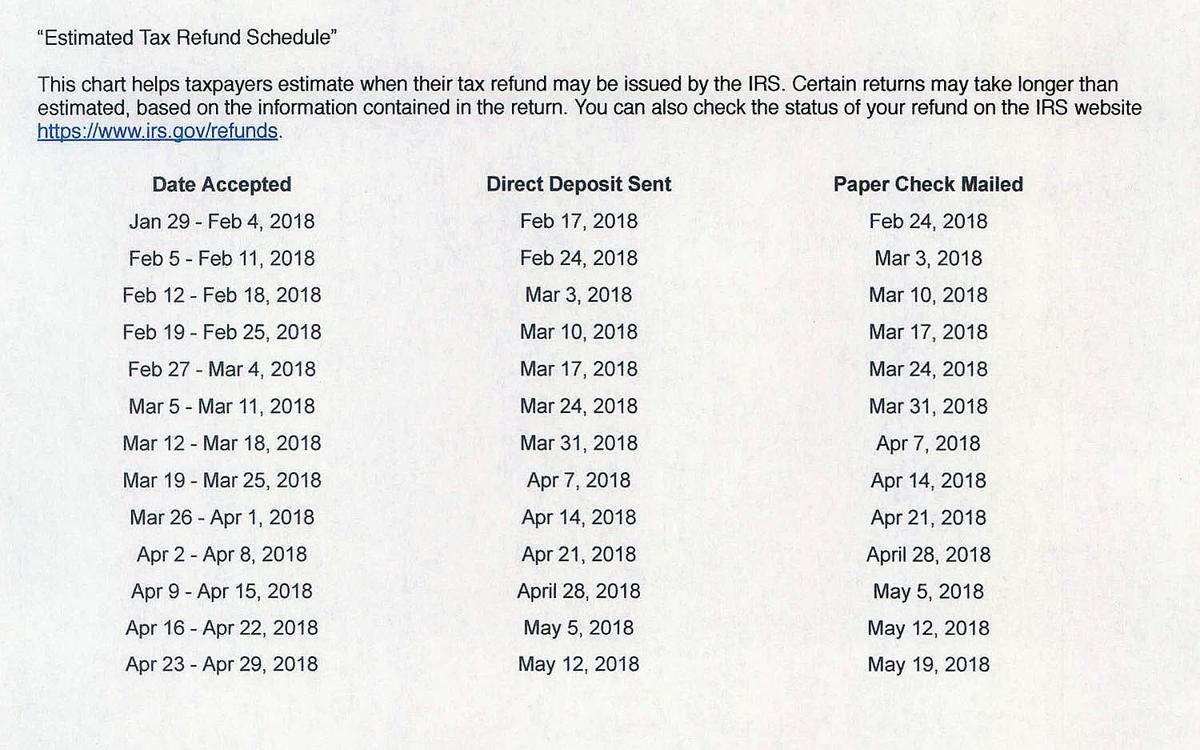

Normally taxes are due by April 15 but the IRS extended the filing deadline to May 17 2021. Answer a few simple questions about your life income and expenses and our free tax refund calculator will give you an idea if you should expect a refund and how muchor if the opposite is true and youll owe the IRS when you file in 2021. The estimated refund date chart is below if you just want to scroll down Although the 2020 tax season was significantly impacted by the Covid-19.

Terms and conditions may vary and are subject to change without notice. You can pay all of your estimated tax by April 15 2021 or in four equal amounts by the dates shown below. It uses a four-week timeframe for.

In general the IRS notes that it issues most refunds within 21 days of receiving your tax filing forms. Estimated taxes are paid on a quarterly basis with payment deadlines being April 15 June 15 September 15 and January 15 of the following year. First check your e-file status to see if your return was accepted.

27 which is consistent with the start date in recent years. While the IRS assured filers at the beginning of tax. April 15 2021 2nd payment.

Estimated Taxes Due April 15 While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15. Want to know your estimated Refund Anticipation or Tax Refund Money in the Bank date. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021.

OBannon Managing Editor - CPA. They will provide an actual refund date as soon as the IRS processes your tax return and approves your refund.