On March 17 2021 the Internal Revenue Service IRS announced that the federal income tax filing due date for all taxpayers for the 2020 tax year will be automatically extended from April 15. If you need additional time to file beyond the May 17 deadline you can request a filing extension until October 15 by filing Form 4868 through your tax professional tax software or using Free File.

Fact Check Irs Moved 2020 Tax Filing Deadline To May 17

Fact Check Irs Moved 2020 Tax Filing Deadline To May 17

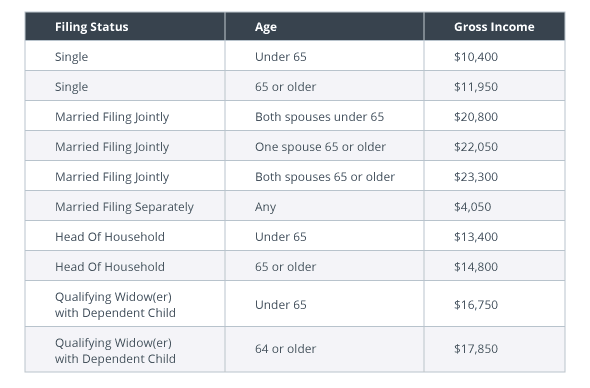

Luckily most teenagers dont earn enough income to be required to file a tax return.

Can i file for taxes at 17. This means you will have less money to deduct from your income to figure out tax on that income. Because Free File returns are filed electronically your tax returns are processed faster than paper ones. Im new to this stuff so i dont know to much.

How much do i need to make to file. Filing Form 4868 gives taxpayers until October 15 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Can a 17 year old file his own taxes.

Taxes dont roll over except for a few items capital losses certain tax credits and net operating losses that are unusual for most adults and extremely rare for someone who is 17. A qualifying child dependent must do so if they have earned income of 12200 or more in the 2019 tax year the amount of the standard deduction for single filers for that year or 1100 in unearned income such as interest and dividends. If for some reason you cant file your federal tax return on time its easy to get an automatic extension to October 15 2021.

Individual taxpayers who need additional time to file beyond the May 17 deadline can request a filing extension until Oct. Get details on the new tax deadlines and on coronavirus tax. I live in Vt.

Can i file for taxes. For those who are self-employed or who have a spousepartner who is self-employed the deadline extends until June 15 2021. Considerations Income that you receive for labor or service is filed under your Social Security number.

The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021. Some exceptions do apply of course. If you choose direct deposit for you tax refund youll get that faster than waiting for a mailed check.

The deadline to file your taxes has been extended to May 17 and youll need to file a Recovery Rebate Credit on your 2020 return if you need to claim any of the 1200 or 600 from the previous. The tax-filing deadline for most Canadians for the 2020 tax year is on April 30 2021. You can file a tax return at any age however if you are 17 and a qualifying child or qualifying relative dependent of another taxpayer you may not take your own exemption.

The IRS is postponing the tax filing deadline to May 17 from April 15 the agency said Wednesday. This years federal tax filing deadline for individuals is Monday May 17. The 2021 tax filing season is on the horizon and kicks off on February 22 2021.

You should talk to your parents. In some cases you may need to file taxes at 17 years old even if your earned or unearned income doesnt meet the dollar threshold that the IRS sets. Assuming your brother has earnings either as an employee or independent contractor then he MUST file his own income tax return.

A person has to be 18 years old for a contract to be valid. But you have to act by May 17 to qualify. I work at McDonalds.

You must file a tax return under some circumstances even if someone else claims you as a dependent. 15 by filing Form 4868 through their tax professional tax software or using the Free File link on IRSgov. Filing Form 4868 gives you until October 15 to file your 2020 tax return but.

When do I need to file taxes by. That will give taxpayers more time to file tax returns and settle bills. Generally any Canadian who earns less than the basic personal credit around 12000 doesnt have to file a return.

The only way your mother can claim him is to declare him as a dependent though her legal ability to do that seems to be in doubt given what youve written.