Rates published are based on a maximum loan to value of 75 for a purchase or 70 loan to value no cash out refinance of a single family primary residences with a credit score of 740 or higher. Well work with you to make sure your mortgage is the perfect fit for your needs.

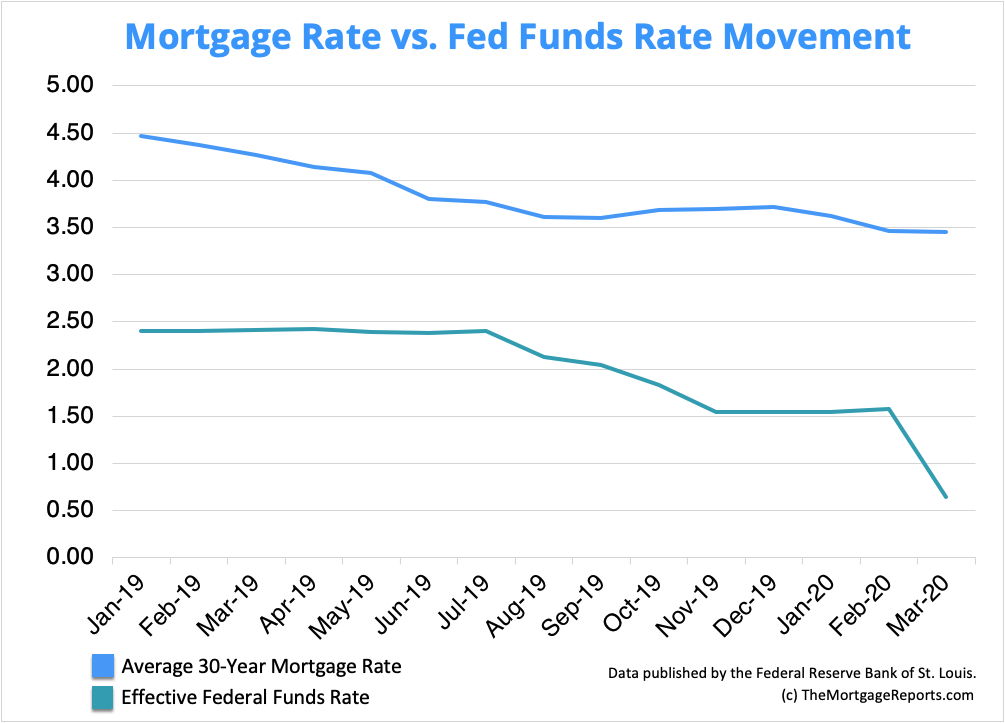

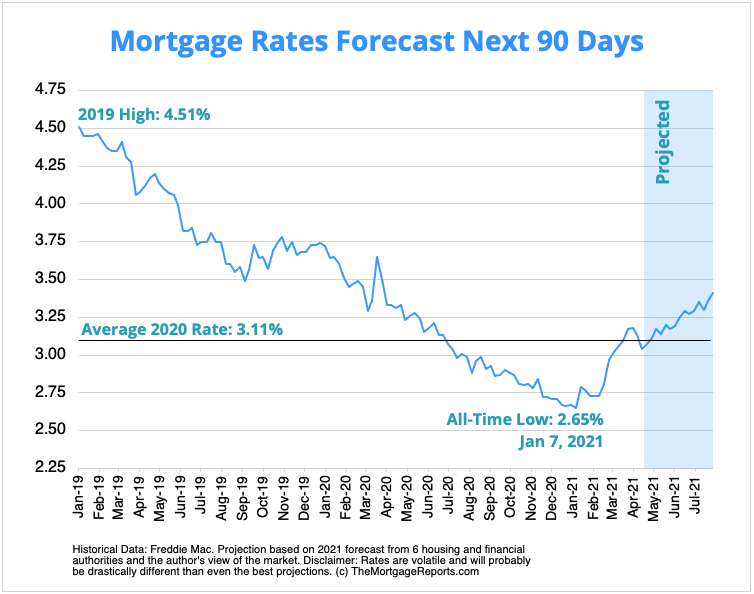

Mortgage Interest Rates Forecast Will Rates Go Down In May

Mortgage Interest Rates Forecast Will Rates Go Down In May

ITHINK Financial in Florida and Georgia offers a variety of home mortgage loans with great rates.

Think mortgage rates. Fixed rate periods are 30 25 20 15 and 10 years. Think Financial mortgage rates are typically in the lowest 10 of rates in the country. Rates are subject to change without notice.

Uninsured mortgages at Think Financial generally entail higher rates. Theres no way for you to know whether an advertised rate is what youll end up getting. In our vast experience we have found it impossible to give everyone cookie-cutter rates for cookie-cutter mortgages what works for one might not be the best fit for someone else.

Every bank and lender in Canada does but to us it didnt seem. Our team is ready to help you identify and obtain the mortgage solution thats best for you. Well ask lots of questions and make recommendations that go beyond advertised rates to ensure your.

Interest Rate and Principle PI Interest payments will not change for the life of the loan. 5 Years Rate is Constant then Adjusts annually based on 1 Year CMT rate plus a margin of 275. A variety of programs rates and terms are available and each factors into making the best mortgage decision.

The Mortgage Bankers Association MBA says it believes the average rate for a 30-year mortgage will start at 29 in the first quarter of 2021 and gradually increase to. 5 Zeilen Rates current as of April 15 2021. The best of all 0 out of my pocket.

We offer our products exclusively through a very limited number of mortgage brokerages that are well known for attracting clients with great credit. A year ago at this time the 30-year fixed-rate mortgage averaged 384. Certificate of Deposit IRA Rates Fixed variable and jumbo certificate of deposit and IRA rates.

Selecting the right mortgage product requires the knowledge and experience of a licensed professional at think one mortgage inc. When acquiring a THINK Mortgage through a mortgage brokerage this fee is often incorporated into a higher mortgage rate. The average rate since 1971 is more than 8 for a 30-year fixed mortgage.

The mortgages are typically sold to third-party investors aggregators and are serviced by a third party MCAP. Purchase a home with as little as 300 down payment. Mortgage Rates Predictions and Analysis MBS Live Automated Mortgage and Real Estate Newsletters.

THINK Mortgage Los Angeles. The companys best deals are usually on its insured mortgages. The only way we can accurately quote you the best rate is to do a free analysis of your situation needs and.

You wont find mortgage rates on our website. Though mortgage rates fluctuate based on market conditions the average rate of the most popular home loan the 30-year fixed was 313 as of June 25 the lowest rate in Freddie Macs survey history which dates back to 1971. Most analysts say a recent global rise in interest rates is likely to soon feed through to a slight rise in fixed mortgage rates However experts warn there are several catches to beware of before.

Another consideration is that some mortgages with very low rates may not give you the options or flexibility you need. We cap our. Went from a 5625 rate with another lender to 3625 with him.

I am extremely satisfied with the teams effort to get everything in order and done in time to close escrow. To see if 35 is a good rate right now and for you get 3-4 mortgage quotes and see what other lenders offer. Whats more certain rates are only available to clients with specific needs or credit qualifications.

And the interest only 219 instead of 25 and 1500 charges plus 10000 add into the loan which not when discussed from beginning. Fixed rate mortgages with Interest Only IO payments are available. I so fed up with them and go with another lender Intelliloan we start to finished exactly 35 days and bonuses that the lender refund back my appraisal 450 less than I paid for Think Mortgage.

Thinking about buying a home. Rates for vehicles watercraft variable rate and personal loans. Plus a 1 administrative fee.

My advice just stay away from Think Mortgage. At THINK Financial we believe good credit clients deserve better rates and straight forward pricing without the hidden fees. Other properties types such as Condominiums Townhouses and investment properties are subject to other loan.

See our current mortgage rates and apply for a home loan today. For example we no longer charge wire fees upon funding of a mortgage. That no money out of my pocket.

A blog keeping you up to date on current mortgage rates and market conditions. I definitely recommend them.