The last date for income tax returns for Financial Year 2018-19 is extended from 31st March 2020 to 30th June 2020. The last tax year started on 6 April 2020 and ended on 5 April 2021.

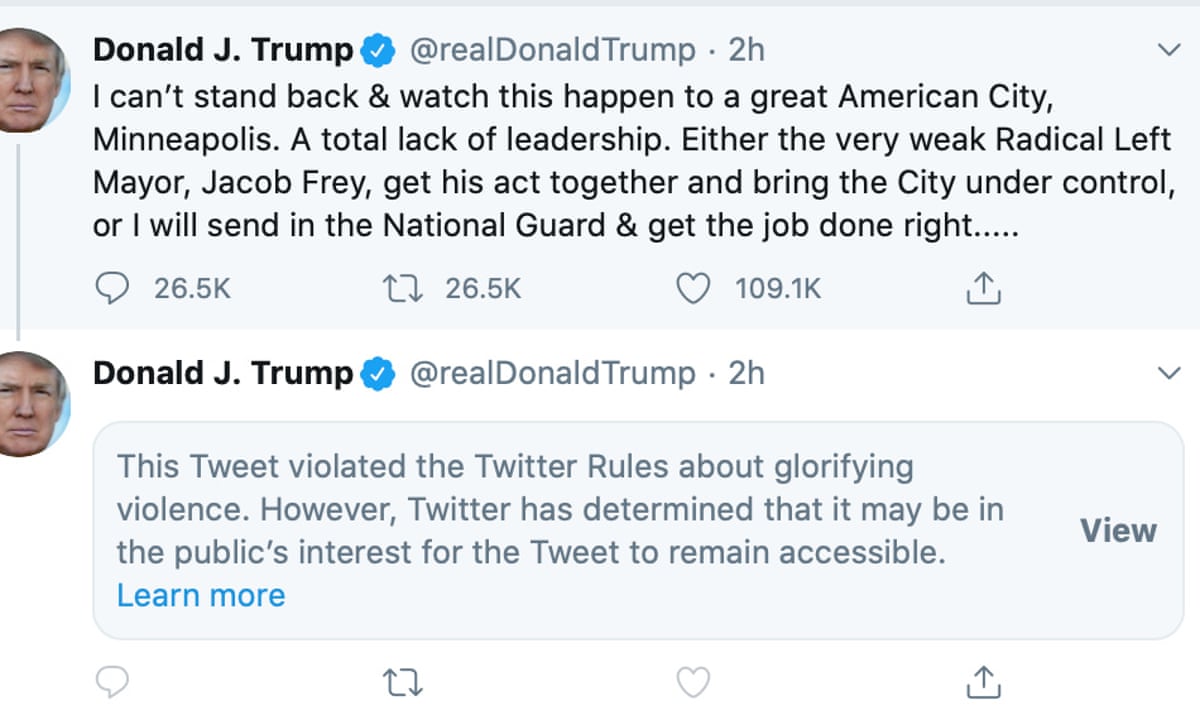

Itr Due Date Extended Fy 2018 19 L Income Tax Return Filing Due Date Extended Ay 2019 20 Youtube

Itr Due Date Extended Fy 2018 19 L Income Tax Return Filing Due Date Extended Ay 2019 20 Youtube

File a 2020 income tax return Form 1040-SR and pay any tax due.

What is the last date for tax return 2019. Annons Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes. The last date of Aadhaar-PAN linking is to be extended from 31st March 2021. This year Revenue has decided to further extend this deadline to Thursday 10 December 2020.

The income tax return AKA Form 11 deadline for 2019s income is the 31st of October 2020. Estimated tax payments are due quarterly with the last payment for 2019 due on Jan. Get A 100 Accuracy Guarantee With HR Block for your US.

Keep in mind if you owe taxes and dont file an extension you might be subject to Tax Penalties. Get A 100 Accuracy Guarantee With HR Block for your US. HMRC must have received your tax return by midnight.

Among other measures Due date of all income-tax return for FY 2019-20 will be extended from 31st July 2020 31st October 2020 to 30th November 2020 and Tax audit from 30th September 2020 to 31st October 2020 The Period of Vivad se Vishwas Scheme for making payment without an additional amount will be extended to 31st December 2020. If the ITR is filed before the expiry of deadline then a penalty will be levied on late filing of ITR for upto Rs 10000. The Income Tax Department on Saturday extended the deadline for individual assessees to file their returns for financial year 2019-20 assessment year 2020-21 by.

That means you should file returns for 2018 and 2019 as soon as possible. Paper tax returns due This is the deadline for filing a paper tax return. Also a part of the group is Irish Tax Rebates a simple fast secure service to help you claim back any overpaid PAYE tax that you may be entitled to.

However if you receive notice from HMRC that you must file a tax return after 31 July 2019 youll need to send back the completed form within three months of the date of issue on the notice. Last day to contribute to an Individual Retirement or Health Savings Account IRAHSA and have it considered retroactive to 2019. Taxpayers in that area who extended their 2019 tax returns to October 15 2020 now have until January 15 2021 to file those returns.

2019 Return refund is April 15 2023. Last day to file an original or amended tax return from 2017 and claim a rebate unless you have an extension then this is October 15 2021. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline.

31 October 2019. Payment options can be found at IRSgovpayments. For the financial year 2019-20 the income tax return deadline has been extended to December 31 2020 from the usual deadline of July 31.

Dont forget your credits. Tax Return Plus is part of the MB Tax Refunds Group a team of specialist tax advisors and qualified Accountants working out of our offices in Athy Co. If you miss this date you have until October 15 2021.

What if I made a mistake and need to refile my taxes. After that date your refund will. For the 2018 tax year with a filing deadline in April of 2019 the three-year grace period ends April 15 2022.

15 2021 you can no longer e-File IRS or State Income back taxes prior to Tax Year 2020. If you file and pay your taxes online the deadline is usually mid-November. Annons Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

Form 1040-ES Estimated Tax for Individuals has a worksheet to help figure these payments. Usually the only time this deadline may differ is if you received a notice to make an online tax return from HMRC after 31 October 2019 in which case you have three months from the date of issue to file. The 2018 Return refund deadline is April 15 2022.

If you have not filed your 2017 IRS Tax Return and expect a tax refund you have until 04152021 to submit the return on paper and to claim your refund.