You know that the tax rate at your state is 75. Rs 250 Lakh Rs 5 Lakh.

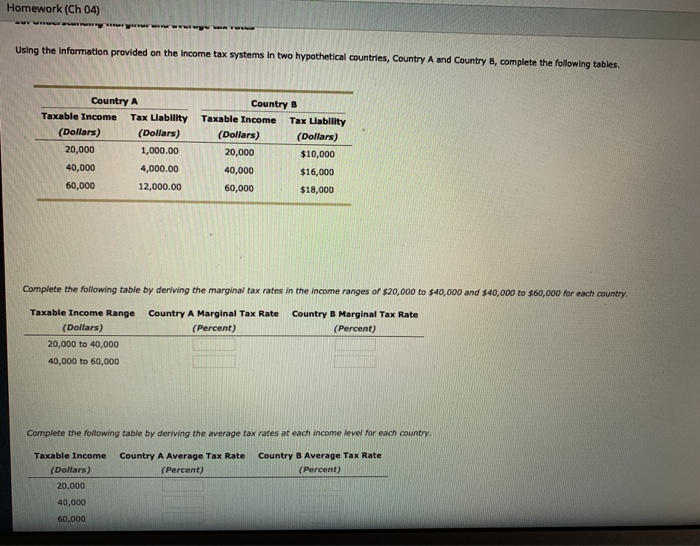

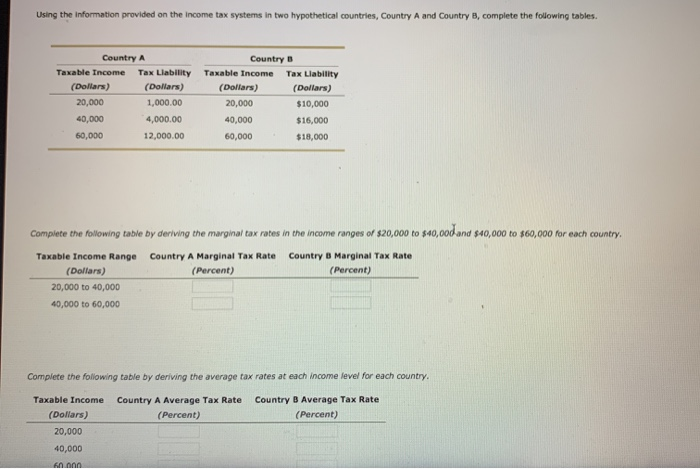

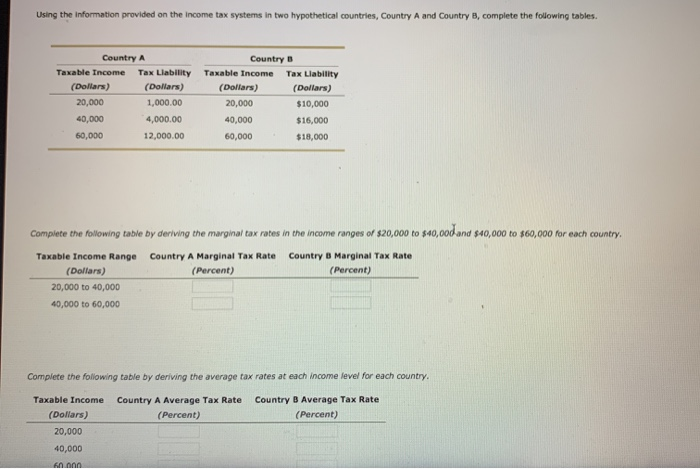

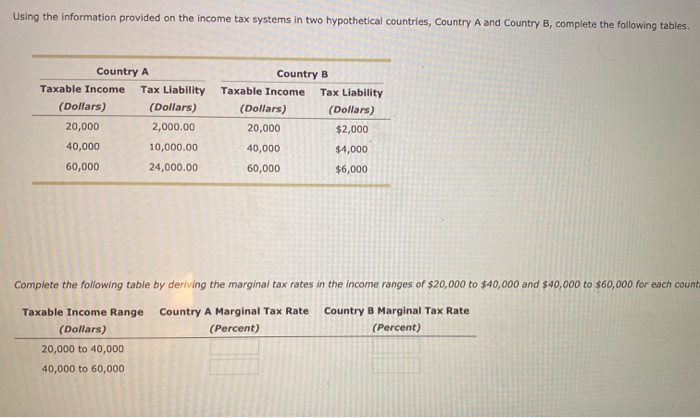

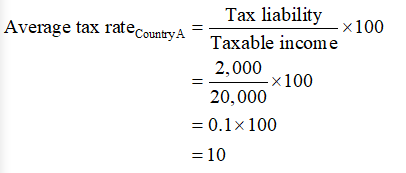

Solved Homework Ch 04 Using The Information Provided On Chegg Com

Solved Homework Ch 04 Using The Information Provided On Chegg Com

The contestant then has to spin for a prize envelope essentially requiring the individual to land on the 1 million wedge again.

What is the tax on 20 000 dollars. Firstly divide the tax rate by 100. 75100 0075 tax rate as a decimal. Rs 5 Lakh Rs 750 Lakh.

75100 0075 tax rate as a decimal. Tax 200 0075 tax 15 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

The state and local income tax will be 9450 a flat 5 of the 189000 of taxable income. Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax price 1 tax rate tax expressed as a decimal 2 You buy a product for 3225 dollars with tax included. The rates range from 18 to 40 and the giver generally pays the tax.

The same goes for the next 30000 12. 10 of the difference. If your base provincial tax is between 4830 and 6182 you pay 20 on the portion of provincial tax owed that is over 4830.

Now find the tax value by multiplying tax rate by the before tax price. Finally each county was ranked and indexed on a scale of 0 to100. Cigarettes are subject to an excise tax of 435 per pack of 20 and other tobacco products have a tax equaling 75 of the wholesale price.

We then added the dollar amount for income sales property and fuel taxes to calculate a total tax burden. Thats an effective tax rate more than double that of the couple earning 100000 a year. If at the end of the year less than 90 of what you owe for taxes has not been withheld for federal income taxes you will be subject to a 10 estimated tax penalty.

Rs 750 Lakh Rs 10 Lakh. To easily divide by 100 just move the decimal point two spaces to the left. 7100 007 tax rate as a decimal.

If California Taxable Amount is 2540 tax across from 25 is 206 and tax across from 40 cents is 03. Taxes on one million dollars of earned income will fall within the highest income bracket mandated by the federal government. In as income and ignore all the rest of the questions enter0 you would get 784.

Finding Taxes on One Million Dollars How much you are taxed on income depends on various factors. To easily divide by 100 just move the decimal point two spaces to the left. Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax price 1 tax rate tax expressed as a decimal 2 You buy a product for 268750 dollars with tax included.

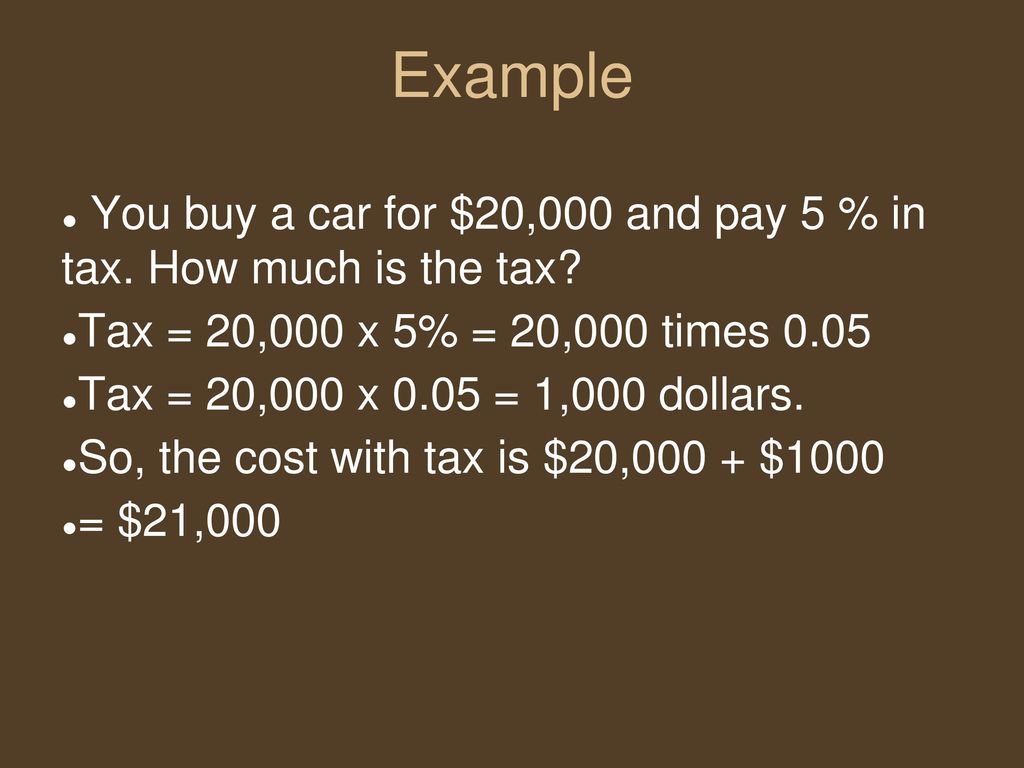

In 2018 this couple owes a grand total of 51245 on 250000 in salary or just over 20. 1 You buy a item on Ebay for 20000 dollars and pay 7 percent in tax. I suggest you use the IRS tax calculator irsgov - individuals - tax rate calculator and if you just plug 20000.

Tax Rate as per New Regime. Income Tax Slab 2019-20. For the 2020 tax year this is a 37 tax rate.

What is the tax on it and what is the total price including tax. Tax Rate as per Old Regime. Rs 10 Lakh Rs 1250 Lakh.

Add 206 03 209. The county with the lowest tax burden received a score of 100 and the remaining counties in the study were scored based on how closely their tax burden compares. The long-term over a year capital gain tax rate is 0 15 or 20 depending on your tax bracket.

In New York City there is an additional 150 excise tax per pack of cigarettes. Then find the tax across from your order cents amount and add the two tax amounts together. As Time explains once you get to the bonus round with the million-dollar wedge one of the prize envelopes which contains 100000 is replaced with the 1 million prize.

Learn how to calculate sales tax by following these examples. Upto Rs 250 Lakh. Firstly divide the tax rate by 100.

You know that the tax rate at your state is 75. The answer depends on many things - filing single or joint gifts to charities even the basic form allows some deductions etc. Dont be afraid to consult with an expert if you want to take advantage of this strategy.

What is the tax on it and what is the total price including tax. To easily divide by 100 just move the decimal point two spaces to the left. Income range per annum.

Rs 1250000 Rs 1500000. 1 You buy a item on Ebay for 20 dollars and pay 75 percent in tax. One can use the Scripboxs.

To compute the sales tax find the tax amount across from your order dollar amount. If youre lucky enough and generous enough to use up your exclusions you may indeed have to pay the gift tax. The envelopes contents are kept secret until the end with the contestant either solving the puzzle or.

Said another way earnings stack upon earnings as the year goes on much like an inverted pyramid. For many investors this means a lower tax rate than their ordinary income tax rate. Firstly divide the tax rate by 100.

Example as highlighted below. To actually pull this off youll need to transfer the stock into a taxable brokerage account.

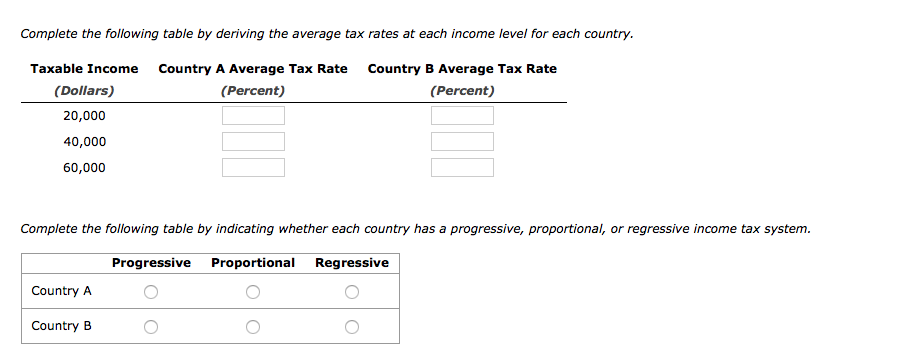

Answered Complete The Following Table By Bartleby

Answered Complete The Following Table By Bartleby

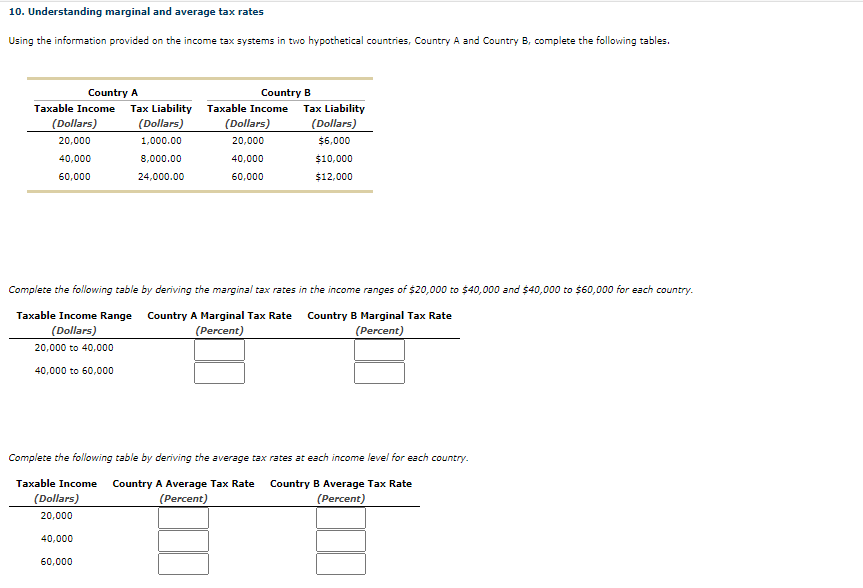

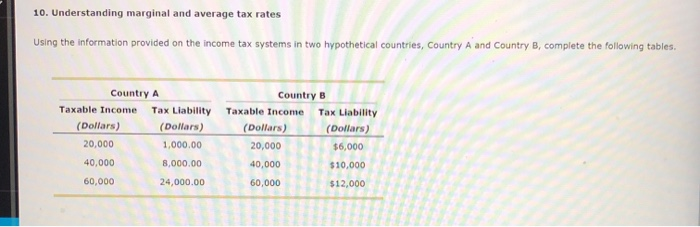

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Sales Tax Discounts Commission Ppt Download

Sales Tax Discounts Commission Ppt Download

If I Make 20 Million Dollars A Year How Much Of It Will Be Deducted And Taxed By The Government Quora

If I Make 20 Million Dollars A Year How Much Of It Will Be Deducted And Taxed By The Government Quora

Solved Using The Information Provided On The Income Tax S Chegg Com

Solved Using The Information Provided On The Income Tax S Chegg Com

Solved Using The Information Provided On The Income Tax S Chegg Com

Solved Using The Information Provided On The Income Tax S Chegg Com

Transfer Tax System Transfer Tax Any Tax That

Transfer Tax System Transfer Tax Any Tax That

Answered 10 Understanding Marginal And Average Bartleby

Answered 10 Understanding Marginal And Average Bartleby

The United States Is Looking For More Than 20 000 In Tax Evaders In The Bitcoin Exchange

The United States Is Looking For More Than 20 000 In Tax Evaders In The Bitcoin Exchange

Chapter 9 Accounting For Depreciation And Income Taxes

Chapter 9 Accounting For Depreciation And Income Taxes

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Solved 10 Understanding Marginal And Average Tax Rates U Chegg Com

Solved I Started Trying To Answer It Myself But I Don T Chegg Com

Solved I Started Trying To Answer It Myself But I Don T Chegg Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.