You receive a distribution from a traditional IRA and. An updated valuation of the assets you wish to convert.

How To Do A Backdoor Roth Ira Save My Cents

How To Do A Backdoor Roth Ira Save My Cents

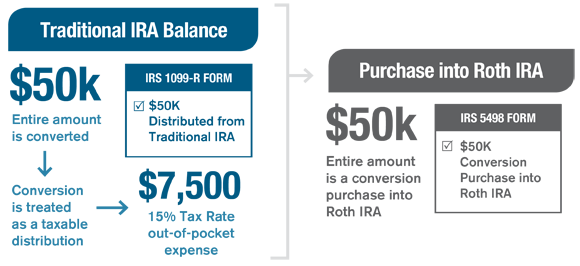

Youll receive two tax documents if you convert your traditional IRA to a Roth IRA and you must report the conversion in two places on your tax return.

How to convert traditional ira to roth. If you are in the 28 tax bracket you will be able to convert 50000 of your IRA into a Roth without losing money. Compare Investments and Savings Accounts Investments. Complete a form indicating how much money you want to convert from your existing IRA account to a Roth IRA account.

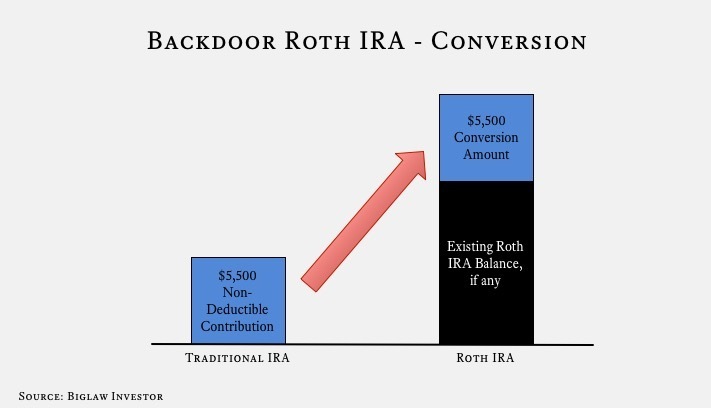

There are two main requirements that Advanta IRA needs to complete a conversion of assets held within a self-directed traditional IRA to a Roth account. Converting to a Roth IRA may ultimately help you save money on income taxes. She would sell 10000 of ABC in her traditional IRA but then convert this amount to a Roth IRA and purchase 10000 in XYZ shares in her Roth IRA.

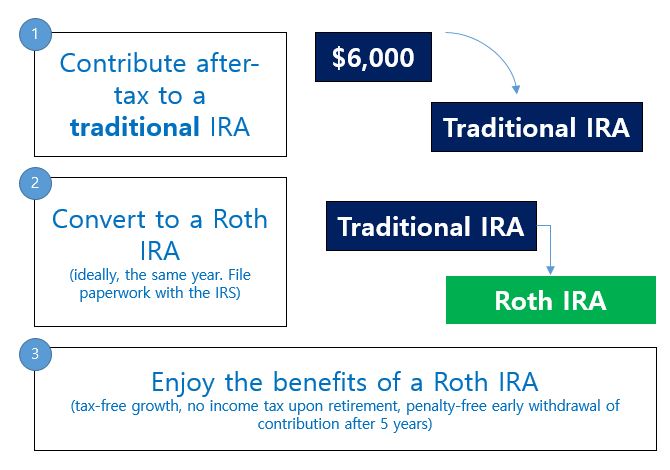

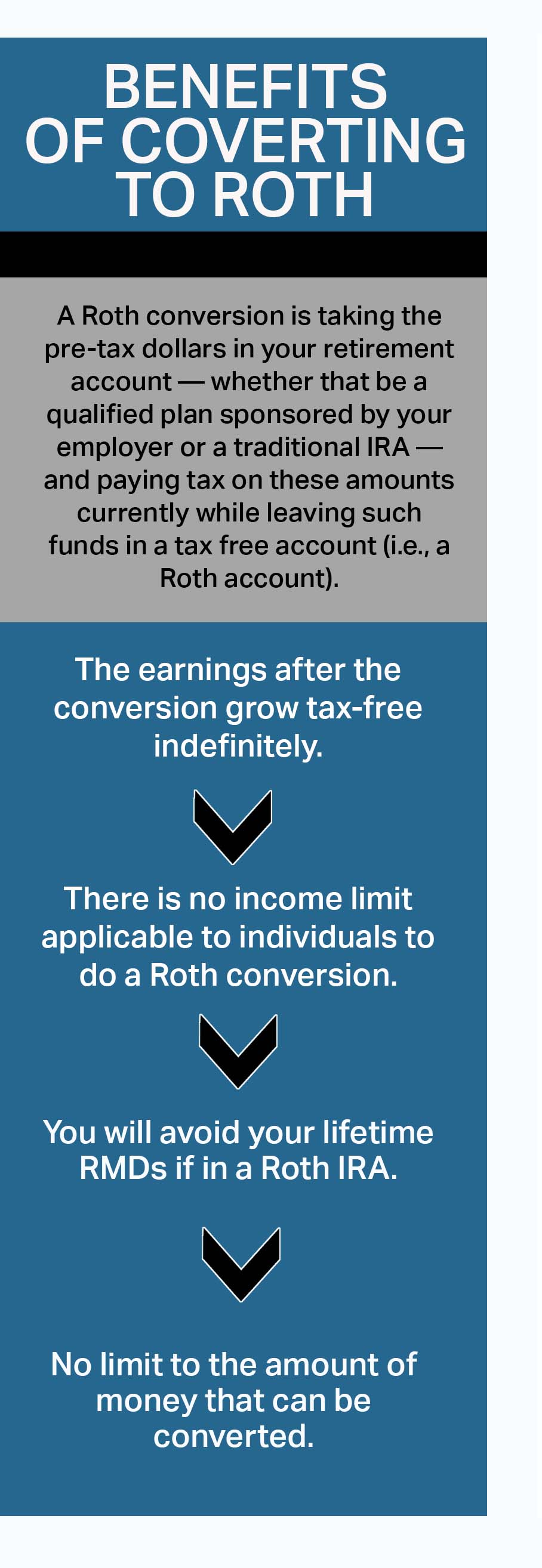

Anyone can convert their eligible IRA assets to a Roth IRA regardless of income or marital status. Keep these rules in mind when converting your IRA. To stay in sync with IRS rules youll want to convert your traditional IRA to a Roth IRA in one of the following ways.

This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. 3 Tell your traditional IRA provider that. Roth IRA Rollover Methods The simplest way to convert to a Roth is a trustee-to-trustee or direct rollover from one financial institution to another.

You can do this for both traditional and Roth IRAs. When you have a lower than average tax rate. However you may want to talk with your financial advisor and determine the best timing.

Heres how to convert a traditional IRA to a Roth IRA. Prior to 2010 only those account owners who had a modified adjusted gross income below 100000 were eligible to convert. On April 5 you could convert your traditional IRA to a Roth IRA.

For example you may want to carry out your conversion. Prior to 2010 individuals or couples with modified adjusted gross income in excess of 100000 were ineligible to convert retirement savings to a Roth IRA. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

Youll receive a Form 1099-R from your financial institution reporting the Roth conversion. The rollover will result in a 14000 tax liability 50000 X 028 but that will be offset by the 7 bonus that you will be paid on the 200000 rollover to the annuity which will be 14000 200000 X 007. The IRS describes three ways to go about it.

Note that Joyce considers the Roth IRA and the traditional IRA as a single portfolio for asset allocation purposes. Documentation you have prepared to properly transfer ownership of the assets from the traditional to the new Roth account. Follow these simple steps to convert your Traditional IRA or old 401k to a Roth IRA.

You could make a traditional IRA contribution on April 1 2021 and designate it as a contribution for your 2020 taxes. Effective January 1 2010 you can convert a Traditional IRA to a Roth IRA regardless of your income level. You can convert a traditional IRA to a Roth IRA at any time.

It will be coded as a rollover to a Roth IRA. How to Convert a Traditional IRA to a Roth IRA Converting all or part of a traditional IRA to a Roth IRA is a fairly straightforward process. A Roth IRA conversion means you pay tax on your savings in the year you move your money from the traditional retirement account to the Roth in order to set up tax-free income later in life.

Open a Roth IRA account at a bank or online brokerage or with a financial advisor. However the conversion cant be reported on your 2020 taxes. You can convert your traditional IRA to a Roth IRA by.

Rollover You receive a distribution from a traditional IRA and contribute it to a Roth IRA within 60 days after the distribution the distribution check is payable to you. Start at your balances and holdings logon required Then locate the traditional IRA you want to convert and click Convert to Roth IRA. Roth IRA Investment Options 2.

If you want to open a new Roth IRA You need to have a Vanguard Roth IRA already set up in order to receive converted assets. Learn how to convert your traditional IRA to a Roth IRA online at.

Backdoor Roth Ira A How To Guide Biglaw Investor

Backdoor Roth Ira A How To Guide Biglaw Investor

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Pause Before Converting Traditional Ira To Roth Carr Riggs Ingram

Pause Before Converting Traditional Ira To Roth Carr Riggs Ingram

How To Access Retirement Funds Early

How To Access Retirement Funds Early

Converting Your Traditional Ira Janus Henderson Investors

Converting Your Traditional Ira Janus Henderson Investors

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Yield Hunting

How To Do A Backdoor Roth Ira Contribution Safely

How To Do A Backdoor Roth Ira Contribution Safely

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Tutorial How Do I Convert A Traditional Ira To A Roth Ira Vanguard Support

Tutorial How Do I Convert A Traditional Ira To A Roth Ira Vanguard Support

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.