With an expense ratio of just 012 Vanguard claims its fee is 90 lower than the average real estate ETF. Buy Commercial Property JLL Careers.

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

First they have a broad diversification of stocks and bonds and second they are relatively low-cost investment vehicles.

Commercial property etf. In a nutshell this is where a variety of stocks or bonds or a mixture of the two become merged as a single fund. You can normally get a pretty stable income and the capital values are less volatile than for equities. So in this article were going to look at four top property ETFs.

Fidelity MSCI Real Estate ETF. All currency hedged share classes of this fund use derivatives to hedge currency risk. ETFs are very much like index and mutual funds in two ways.

About JLL Locations Meet our leaders. Plus since most REITs invest in a single type of commercial property a REIT ETF can give you broader exposure to commercial real estate assets. IShares Core US REIT ETF.

This ETF has taken a slightly different approach that seeks to minimise the SPASX 200 A-REIT indexs concentration whereby more than 90 per cent of its exposure comes from just 10 companies. A Better Way to Invest in Commercial Property. Real estate investment trusts REITs are companies that own operate or finance income-generating real estate and offer investors a way to invest in the real estate sector without having to buy.

Theres the Vanguard ETF mentioned above but. Real Estate Select Sector SPDR SPDR Dow Jones REIT ETF. The two largest of these as mentioned above are Goodman Group.

18 Zeilen Global Real Estate ETFs invest in real estate companies from all over the world. Commercial property is often seen as a great way to diversify your portfolio. Top REIT ETFs for Commercial Real Estate Yield Exchange traded funds tracking commercial real estate have outpaced the SP 500 the past few years and more investors are gravitating to REIT ETFs.

Vanguard is the largest mutual fund company around and continues to absorb funds at a rapid rate. Probably the easiest way to short commercial real estate would be to short one of the ETFs. To see more information of the Real Estate ETFs click on one of the tabs above.

Real Estate Investment Trusts REITs are companies that directly own operate or finance income-producing property. Commercial property real estate ETFs. Commercial real estate ETFs tend to have holdings in companies that purchase and rent properties solely for business.

Here are the best Real Estate Funds ETFs. While Invesco has not named the companies the ETF will target Boston Properties Unibail-Rodamco-Westfield and GPT Group are among the 73 real estate investment trusts REITs in MSCIs index which since November 2008 has slightly edged MSCIs World index. An ETF is short for an exchange-traded fund.

Property investments are subject to adverse changes in economic conditions adverse local market conditions and risks associated with the acquisition financing and ownership and operation and disposal of real property. They typically focus on commercial property shopping malls hotels office blocks etc rather than residential they are tradeable on the stock exchange and they pool investors cash in diversified holdings - think of them as the equivalent of mutual funds for real estate. But before we do that lets look at three wider issues for the sector.

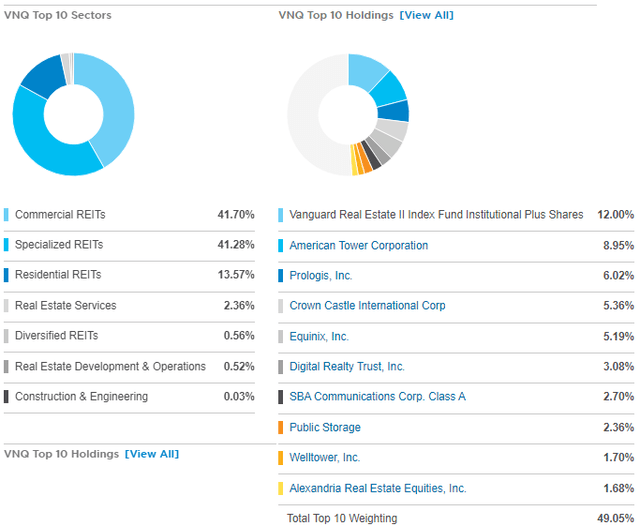

Vanguard Real Estate ETF trades under the ticker VNQ and is commonly looked at as one of the best real estate ETFs available today. And ETFs offer a cheap way to invest in the asset class. Also in the Australian listed property space the VanEck Vectors Australian Property ETF MVA holds a Morningstar Bronze rating.

Real estate exchange-traded funds ETFs hold baskets of securities in the real estate sector providing investors with a less expensive way to invest in. Rather than investing directly in the underlying assets property ETFs invest in the equity of real. The use of derivatives for a share class could pose a potential risk of contagion also known as spill.

IShares Global REIT ETF. If you want to browse ETFs with more flexible selection criteria visit our screener. Still in order to succeed more green.

Direxion S Leveraged Etfs Two Smart Ways To Play Real Estate Swings

Direxion S Leveraged Etfs Two Smart Ways To Play Real Estate Swings

Investing In Reits 101 The Pros And Cons Millionacres

Investing In Reits 101 The Pros And Cons Millionacres

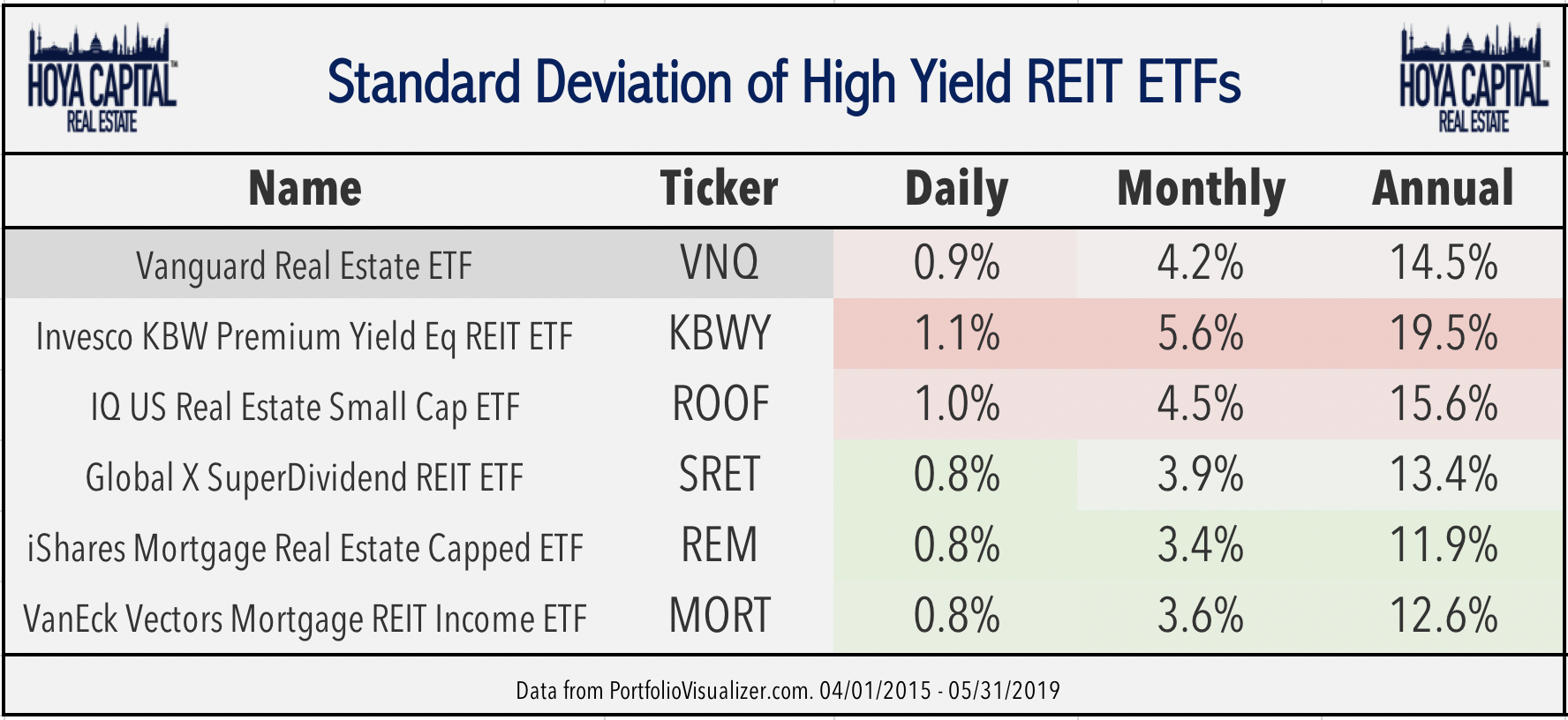

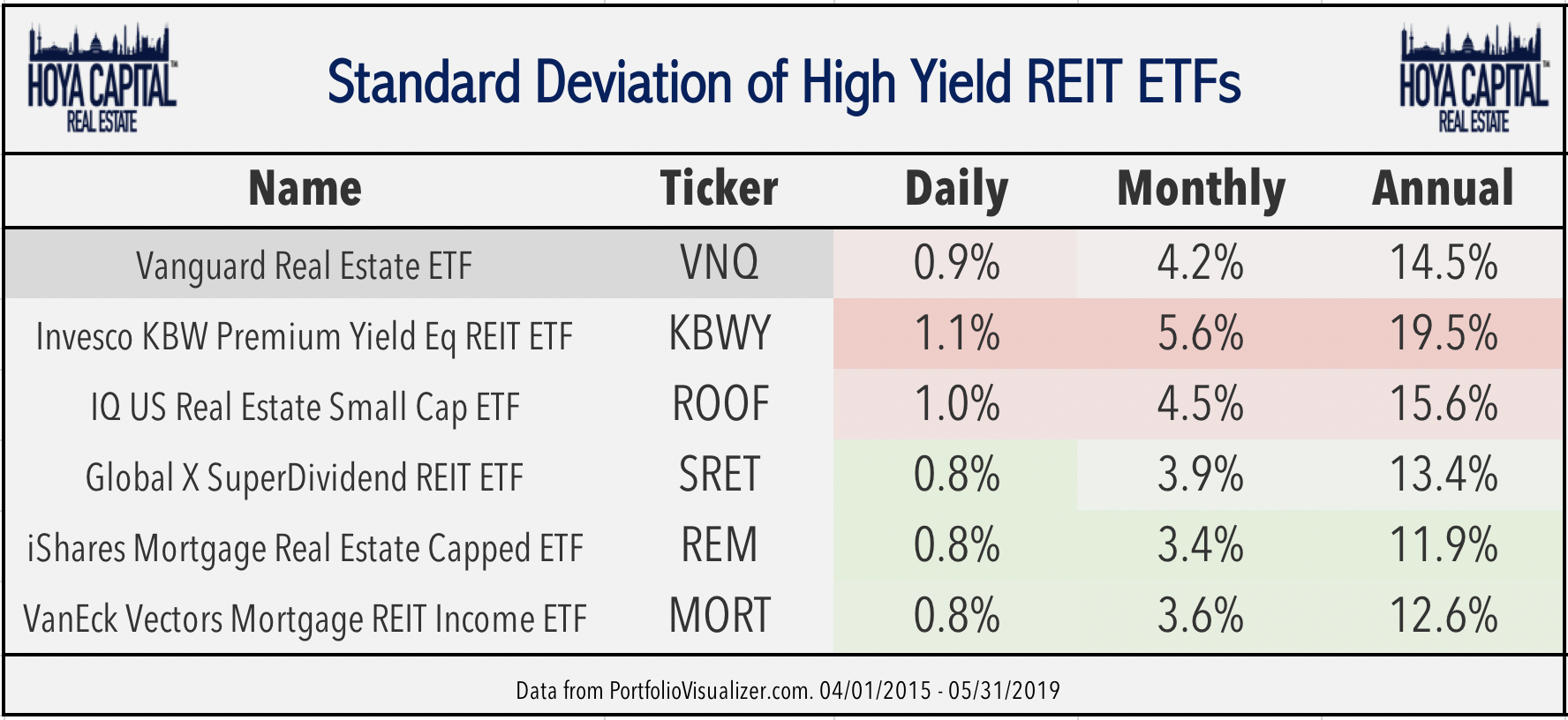

5 High Yield Real Estate Etfs For Income Investors Seeking Alpha

5 High Yield Real Estate Etfs For Income Investors Seeking Alpha

Vanguard Real Estate Etf A Mixed Picture With Some Strong Positives Nysearca Vnq Seeking Alpha

Vanguard Real Estate Etf A Mixed Picture With Some Strong Positives Nysearca Vnq Seeking Alpha

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

5 Best Commercial Real Estate Etfs Right Now Benzinga

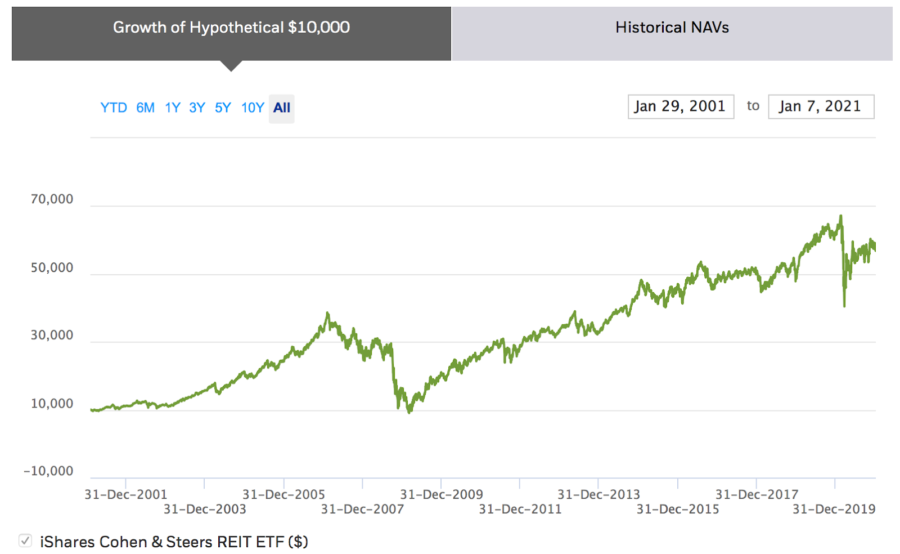

Vnq A David Vs Goliath Story Nysearca Vnq Seeking Alpha

Vnq A David Vs Goliath Story Nysearca Vnq Seeking Alpha

Warehouse Reit Etf Capitalizes On E Commerce Growth Etf Trends

Warehouse Reit Etf Capitalizes On E Commerce Growth Etf Trends

Top Real Estate Etfs Right Now Updated Daily Benzinga

/dotdash_Final_Reasons_to_Invest_in_Real_Estate_vs_Stocks_Sep_2020-01-295563d87e5544768126b5b0d8822891.jpg) Reasons To Invest In Real Estate Vs Stocks

Reasons To Invest In Real Estate Vs Stocks

Use Reits To Invest Like A Property Mogul Wsj

Use Reits To Invest Like A Property Mogul Wsj

Why Real Estate Etfs Now Etf Com

Why Real Estate Etfs Now Etf Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.