However gap insurance needs to be taken with a large pinch of salt. Well talk about the benefits of GAP insurance.

Get Gap Insurance For New And Leased Cars Insurance Com

Get Gap Insurance For New And Leased Cars Insurance Com

In the event of your vehicle being declared a Total Loss our Finance Lease and Contract Hire gap insurance will pay the difference between the outstanding finance balance and the motor insurers settlement.

Lease gap insurance. The specific gap policy covers for instance 4000. If you choose to buy gap insurance this is the gap it covers. GAP insurance or guaranteed asset protection insurance to give it its full name is designed to protect you when you lease or buy a new car.

Lease Gap Insurance - If you are looking for a way to protect your vehicle then an extended warranty is a perfect choice. Dealerships usually sell it and policies are priced between 100 and 300 for three years worth of cover. Learn about what gap insurance guaranteed asset protection protects and when you might need it.

Gap insurance is not a necessity its optional. Unfortunately main insurers of a lease car will only offer a settlement figure which reflects its worth at the time its declared a total loss. Knowing you have gap insurance provides big relief in the event your newly leased car is wrecked shortly after getting it.

However a gap insurance policy can be a valuable coverage option for drivers with new vehicles as it offers financial protection in. GAPCoverage is designed to protect your investment. Gap insurance is an optional insurance coverage for newer cars that can be added to your collision insurance policy.

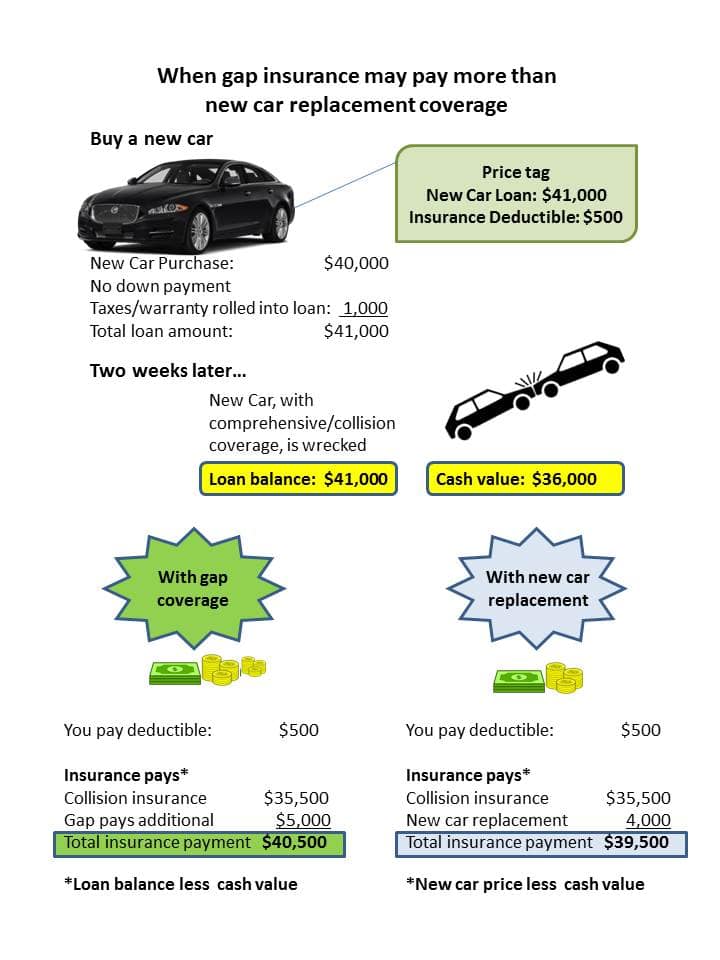

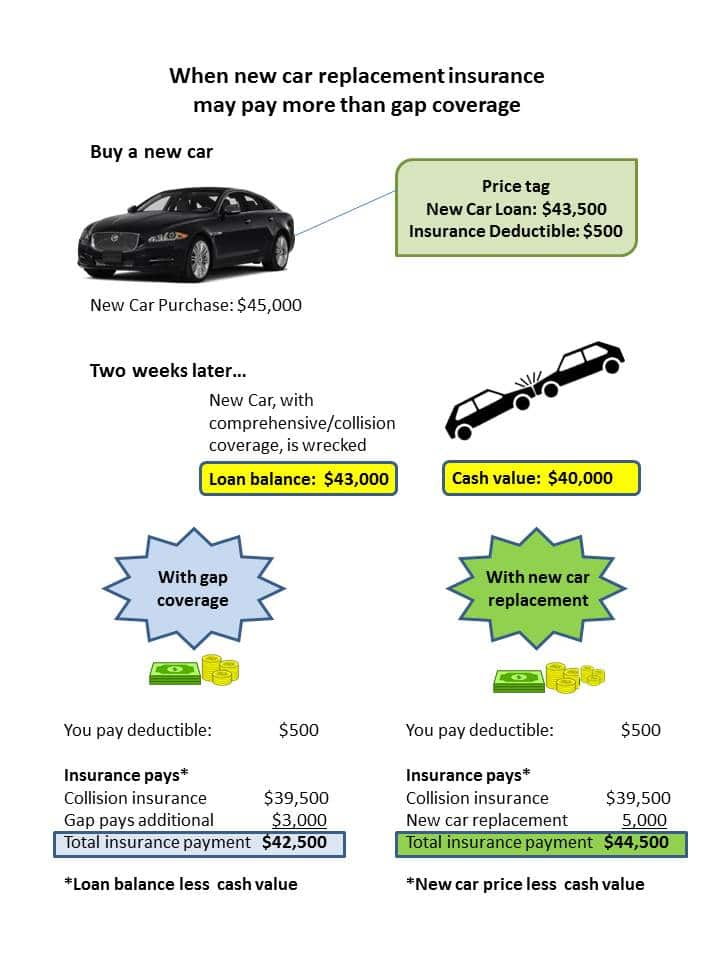

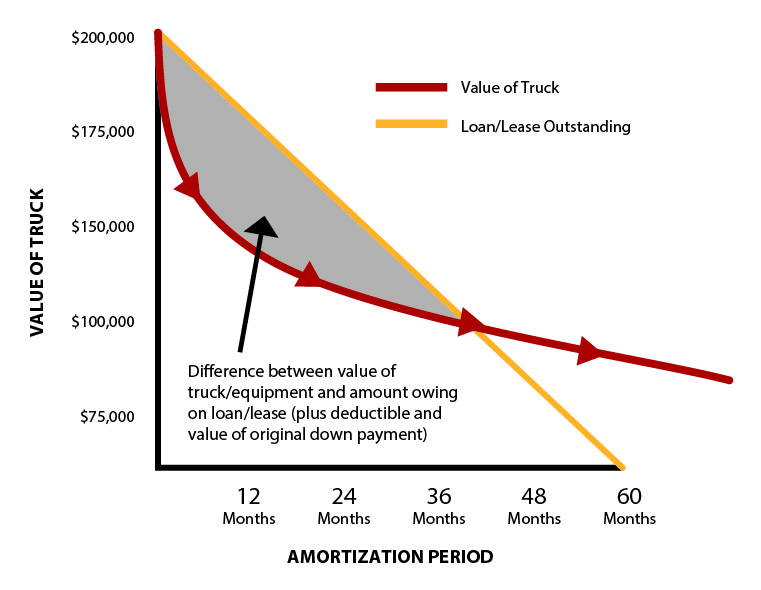

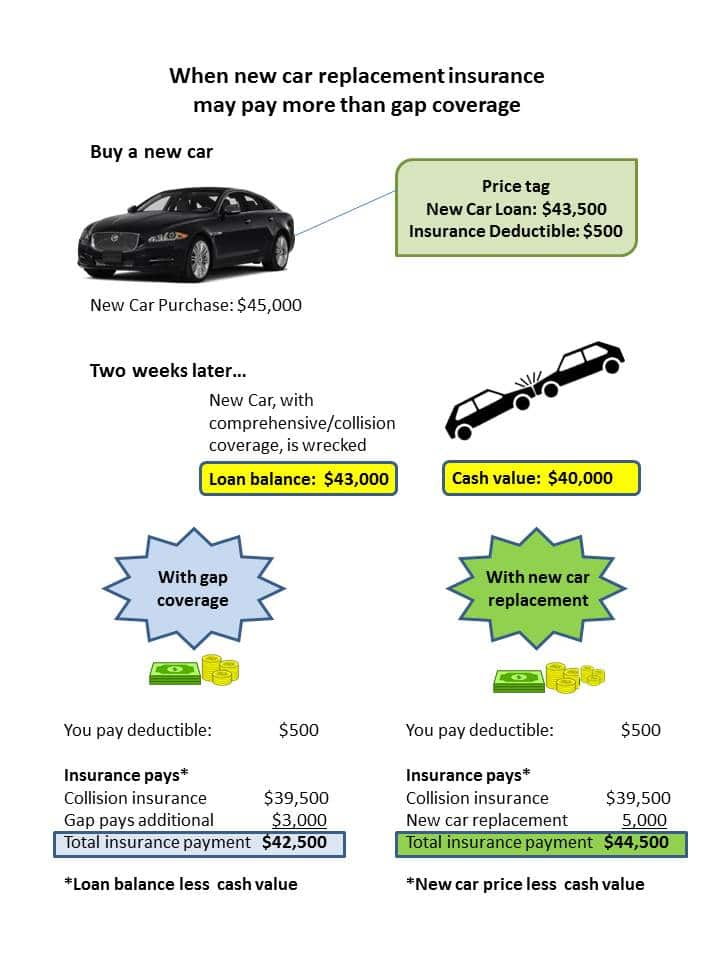

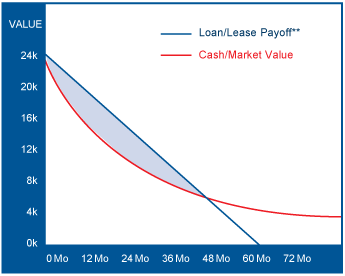

If your insurance company totals out the car it will only pay for the actual value of the car which often times does not cover paying off your car loan. Loanlease gap coverage pays the difference between the actual cash value of your vehicle and the unpaid balance on your loan or lease if your vehicle is totaled due to a loss covered by your comprehensive or collision insurance. Lease GAP Insurance if youve leased your car or got it on a contract hire purchase this will cover you not just for the remaining repayments youd still need to pay after writing the car off but itll also cover you for any of the extra costs that were part of your contract agreement.

For example most agreements will include early repayment charges which can be very expensive just like on a mortgage. Finance Lease Contract Hire Gap Insurance. In short it covers the gap between what your car insurer pays and the actual value of your car in the event of a write off.

GAPCoverage bridges the gap between your finance balance and your vehicles insurance settlement plus up to 1000 toward your deductible. If you purchase GAP insurance you must carry full insurance coverage like comprehensive and collision coverage with your insurance company for GAP insurance to pay out. Cover will include up to a maximum of 250 motor insurance excess.

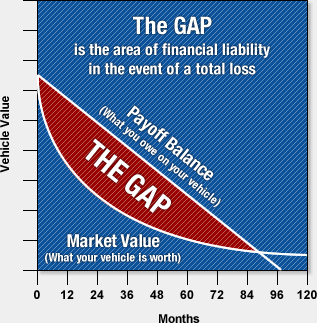

Essentially a GAP insurance policy will bridge the difference between your insurers payout and the finance owed on your lease car if its declared a total loss. Tips About Insurance When You Lease a Car. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the cars depreciated value.

GAP typically waives or pays the deficiency balance minus certain fees and charges between the amount owed on your finance or lease contract and your auto insurance settlement at the time of total loss. See your auto insurance policy for actual coverage in the event of a total loss. GAP insurance is a form of optional vehicle cover you can choose when leasing a car.

When your loan amount is more than your vehicle is worth gap insurance coverage pays the difference. If your Ford is stolen and not recovered or if its declared a total loss your insurance company may not pay enough to satisfy what you still owe. It may pay the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss.

For example if you owe 25000 on your loan and your car is only worth 20000 your policys loanlease payoff coverage covers the 5000 gap minus your. Gap insurance isnt required of drivers in Texas in fact the state prohibits a gap waiver to be a requirement of a car lease or loan. Because you do not own the car outright and are only leasing it you likely can not take minimum car insurance.

Gap insurance also known as loanlease payoff is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. Gap insurance only fills the gap between the actual cash value of a car at the time of a claim and the current amount still owed on a car loan. Guaranteed Asset Protection or GAP is a debt cancellation waiver or insurance product that is designed to assist with covering the difference between the balance owed on the vehicle financing and the amount of the insurance proceeds received from your automobile insurance carrier in the event of total loss of the vehicle.

Gap insurance may also be called loanlease gap coverage This type of coverage is only available if youre the original loan- or leaseholder on a new vehicle.

How To Decide If You Need Gap Insurance

How To Decide If You Need Gap Insurance

What Is Gap Insurance And How Does It Work Allstate

What Is Gap Insurance And How Does It Work Allstate

What Is Gap Insurance And Is It Worth It

What Is Gap Insurance And Is It Worth It

Understanding Auto Insurance Gap Coverage

Understanding Auto Insurance Gap Coverage

What Is Gap Insurance Lexington Law

What Is Gap Insurance Lexington Law

What Is Gap Insurance And How Does It Work Allstate

What Is Gap Insurance And How Does It Work Allstate

What Is Gap Insurance Is It Worth It

What Is Gap Insurance Is It Worth It

Guaranteed Asset Protection Hendrick Autoguard Inc

Guaranteed Asset Protection Hendrick Autoguard Inc

Bridging The Gap When Do I Need Gap Insurance

Do You Need Gap Insurance Auto Loan Education First Federal Credit Union

How Does Gap Insurance Work Ramseysolutions Com

How Does Gap Insurance Work Ramseysolutions Com

What Is Gap Insurance How Does It Work Expert S Guide

What Is Gap Insurance How Does It Work Expert S Guide

Get Gap Insurance For New And Leased Cars Insurance Com

Get Gap Insurance For New And Leased Cars Insurance Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.